0001535778FalseN-2/ANoxbrli:pureiso4217:USDiso4217:USDxbrli:sharesxbrli:shares00015357782024-11-192024-11-190001535778dei:BusinessContactMember2024-11-192024-11-190001535778ck0001535778:UncertaintyToTheValueOfPortfolioInvestmentsRiskMember2024-11-192024-11-190001535778ck0001535778:AdvisersManagementAndDeploymentOfCapitalRiskMember2024-11-192024-11-190001535778ck0001535778:InterestRateEnvironmentAndChangesInInterestRatesRiskMember2024-11-192024-11-190001535778ck0001535778:CompetitionForInvestmentOpportunitiesRiskMember2024-11-192024-11-190001535778ck0001535778:DependentUponAdvisersInvestmentPersonnelForFutureSuccessRiskMember2024-11-192024-11-190001535778ck0001535778:DependentUponAdvisersInvestmentPersonnelAndResourcesProvidedByMainStreetUnderASharingAgreementRiskMember2024-11-192024-11-190001535778ck0001535778:AbilityToAttractAndRetainQualifiedPersonnelRiskMember2024-11-192024-11-190001535778ck0001535778:MayNotReplicateHistoricalResultsRiskMember2024-11-192024-11-190001535778ck0001535778:DependsToASignificantExtentUponStrongReferralRelationshipsRiskMember2024-11-192024-11-190001535778ck0001535778:BoardOfDirectorsMayChangeOperatingPoliciesAndStrategiesRiskMember2024-11-192024-11-190001535778ck0001535778:NonDiversifiedInvestmentCompanyRiskMember2024-11-192024-11-190001535778ck0001535778:CashBalancesMayExceedFDICLimitsRiskMember2024-11-192024-11-190001535778ck0001535778:CorporateSocialResponsibilityRiskMember2024-11-192024-11-190001535778ck0001535778:BylawsIncludeAnExclusiveForumSelectionProvisionRiskMember2024-11-192024-11-190001535778ck0001535778:InvestmentsMayLoseMoneyRiskMember2024-11-192024-11-190001535778ck0001535778:EconomicRecessionsOrDownturnsRiskMember2024-11-192024-11-190001535778ck0001535778:RisingCreditSpreadsAndInterestRatesRiskMember2024-11-192024-11-190001535778ck0001535778:InflationRiskMember2024-11-192024-11-190001535778ck0001535778:OriginalIssueDiscountOrPIKInterestRiskMember2024-11-192024-11-190001535778ck0001535778:LiquidityRiskMember2024-11-192024-11-190001535778ck0001535778:MayNotHaveFundsToMakeInvestmentsRiskMember2024-11-192024-11-190001535778ck0001535778:ClaimsOfOtherCreditorsRiskMember2024-11-192024-11-190001535778ck0001535778:ControlOfPortfolioCompaniesRiskMember2024-11-192024-11-190001535778ck0001535778:PortfolioCompaniesDefaultRiskMember2024-11-192024-11-190001535778ck0001535778:UnrealizedDepreciationRiskMember2024-11-192024-11-190001535778ck0001535778:PrepaymentsOfDebtInvestmentsRiskMember2024-11-192024-11-190001535778ck0001535778:CovenantLiteLoansRiskMember2024-11-192024-11-190001535778ck0001535778:MayNotRealizeGainsFromEquityInvestmentsRiskMember2024-11-192024-11-190001535778ck0001535778:InvestmentsInForeignSecuritiesRiskMember2024-11-192024-11-190001535778ck0001535778:EffectsOfLeverageRiskMember2024-11-192024-11-1900015357782024-09-302024-09-300001535778ck0001535778:SeniorSecuritiesObligationsRiskMember2024-11-192024-11-190001535778ck0001535778:RevolvingCreditFacilityRiskMember2024-11-192024-11-190001535778ck0001535778:AbilityToSellInvestmentsHeldByAStructuredSubsidiaryRiskMember2024-11-192024-11-190001535778ck0001535778:InvestmentsInDerivativesRiskMember2024-11-192024-11-190001535778ck0001535778:ConflictsOfInterestMayLeadToRiskierInvestmentsRiskMember2024-11-192024-11-190001535778ck0001535778:ObligatedToPayIncentiveCompensationRiskMember2024-11-192024-11-190001535778ck0001535778:ConflictsOfInterestInAllocatingInvestmentOpportunitiesRiskMember2024-11-192024-11-190001535778ck0001535778:AbilityToEnterIntoTransactionsWithOurAffiliatesIsRestrictedRiskMember2024-11-192024-11-190001535778ck0001535778:LiabilityIsLimitedUnderTheAdvisoryAgreementMayLeadAdviserToActInARiskierMannerRiskMember2024-11-192024-11-190001535778ck0001535778:AdviserCanResignRiskMember2024-11-192024-11-190001535778ck0001535778:BDCConstraintsRiskMember2024-11-192024-11-190001535778ck0001535778:BDCRegulationsRiskMember2024-11-192024-11-190001535778ck0001535778:LegislationMayAllowAdditionalLeverageRiskMember2024-11-192024-11-190001535778ck0001535778:InvestmentInSecuritiesMayInvolveRiskMember2024-11-192024-11-190001535778ck0001535778:NoActiveTradingMarketForCommonStockRiskMember2024-11-192024-11-190001535778ck0001535778:MarketPriceForCommonStockMayBeVolatileRiskMember2024-11-192024-11-190001535778ck0001535778:DistributionsRiskMember2024-11-192024-11-190001535778ck0001535778:PurchasesOfCommonStockUnderRule10b51RiskMember2024-11-192024-11-190001535778ck0001535778:SalesOfCommonStockInPublicMarketRiskMember2024-11-192024-11-190001535778ck0001535778:ClosingOfTheOfferingRiskMember2024-11-192024-11-190001535778ck0001535778:StockholdersMayExperienceDilutionInTheirOwnershipPercentageRiskMember2024-11-192024-11-190001535778ck0001535778:UseOfProceedsRiskMember2024-11-192024-11-190001535778ck0001535778:ArticlesOfIncorporationCouldDeterTakeoverAttemptsRiskMember2024-11-192024-11-190001535778ck0001535778:PreferredStockRiskMember2024-11-192024-11-190001535778ck0001535778:CorporateLevelU.S.FederalIncomeTaxRiskMember2024-11-192024-11-190001535778ck0001535778:MaintainingRICTaxTreatmentRiskMember2024-11-192024-11-190001535778ck0001535778:DividendsPaidWithStockRickMember2024-11-192024-11-190001535778ck0001535778:StockholdersCurrentTaxLiabilityRiskMember2024-11-192024-11-190001535778ck0001535778:LegislativeOrRegulatoryTaxChangesRiskMember2024-11-192024-11-190001535778ck0001535778:OutsideEventsIncludingPublicHealthCrisesSupplyChainDisruptionsAndInflationRiskMember2024-11-192024-11-190001535778ck0001535778:MarketConditionsMayAffectDebtAndEquityCapitalMarketsRiskMember2024-11-192024-11-190001535778ck0001535778:FailureToComplyWithApplicableLawsOrRegulationsRiskMember2024-11-192024-11-190001535778ck0001535778:FluctuationsInOperatingResultsRiskMember2024-11-192024-11-190001535778ck0001535778:TechnologicalInnovationsAndIndustryDisruptionsRiskMember2024-11-192024-11-190001535778ck0001535778:InformationSystemsAndSystemsFailuresRiskMember2024-11-192024-11-190001535778ck0001535778:FailureInCybersecuritySystemsRiskMember2024-11-192024-11-190001535778ck0001535778:CorporateFacilityMember2014-12-310001535778ck0001535778:CorporateFacilityMember2015-12-310001535778ck0001535778:CorporateFacilityMember2016-12-310001535778ck0001535778:CorporateFacilityMember2017-12-310001535778ck0001535778:CorporateFacilityMember2018-12-310001535778ck0001535778:CorporateFacilityMember2019-12-310001535778ck0001535778:CorporateFacilityMember2020-12-310001535778ck0001535778:CorporateFacilityMember2021-12-310001535778ck0001535778:CorporateFacilityMember2022-12-310001535778ck0001535778:CorporateFacilityMember2023-12-310001535778ck0001535778:CorporateFacilityMember2024-09-300001535778ck0001535778:SPVFacilityMember2021-12-310001535778ck0001535778:SPVFacilityMember2022-12-310001535778ck0001535778:SPVFacilityMember2023-12-310001535778ck0001535778:SPVFacilityMember2024-09-300001535778ck0001535778:SeriesANotesMember2021-12-310001535778ck0001535778:SeriesANotesMember2022-12-310001535778ck0001535778:SeriesANotesMember2023-12-310001535778ck0001535778:SeriesANotesMember2024-09-300001535778ck0001535778:DeutscheBankCreditFacilityMember2014-12-310001535778ck0001535778:DeutscheBankCreditFacilityMember2015-12-310001535778ck0001535778:DeutscheBankCreditFacilityMember2016-12-310001535778ck0001535778:DeutscheBankCreditFacilityMember2017-12-310001535778ck0001535778:DeutscheBankCreditFacilityMember2018-12-310001535778ck0001535778:DeutscheBankCreditFacilityMember2019-12-310001535778ck0001535778:DeutscheBankCreditFacilityMember2020-12-310001535778us-gaap:CommonStockMember2024-11-192024-11-190001535778us-gaap:PreferredStockMember2024-11-192024-11-190001535778ck0001535778:SPVFacilityMember2024-09-302024-09-300001535778ck0001535778:CorporateFacilityMember2024-09-302024-09-300001535778ck0001535778:SeriesANotesMember2024-09-302024-09-300001535778ck0001535778:SPVFacilityMember2023-12-312023-12-310001535778ck0001535778:CorporateFacilityMember2023-12-312023-12-310001535778ck0001535778:SeriesANotesMember2023-12-312023-12-3100015357782023-12-312023-12-310001535778ck0001535778:SPVFacilityMember2024-11-192024-11-190001535778ck0001535778:CorporateFacilityMember2024-11-192024-11-190001535778ck0001535778:SeriesANotesMember2024-11-192024-11-19

As filed with the Securities and Exchange Commission on November 19, 2024

Securities Act File No. 333-282501

| | | | | | | | | | | | | | |

| | | | |

| | UNITED STATES | | |

| SECURITIES AND EXCHANGE COMMISSION | |

| | Washington, D.C. 20549 | | |

| | | | |

| | FORM N-2 | | |

| | | | |

| REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933 | þ |

| Pre-Effective Amendment No. 1 | þ |

| Post-Effective Amendment | o |

| | MSC Income Fund, Inc. | | |

| (Exact name of registrant as specified in charter) | |

| | 1300 Post Oak Boulevard, 8th Floor | | |

| | Houston, TX 77056 | | |

| | (713) 350-6000 | | |

| | (Address and telephone number, including area code, of principal executive offices) | | |

| | Dwayne L. Hyzak | | |

| | Chief Executive Officer | | |

| | MSC Income Fund, Inc. | | |

| | 1300 Post Oak Boulevard, 8th Floor | | |

| | Houston, TX 77056 | | |

| | (Name and address of agent for service) | | |

| | COPIES TO: | | |

| | | | | | | | | | | | | | |

Jason B. Beauvais, Esq.

Executive Vice President, General Counsel and Secretary

MSC Income Fund, Inc.

1300 Post Oak Boulevard, 8th Floor

Houston, TX 77056 | | Harry S. Pangas, Esq.

Clay Douglas, Esq.

Dechert LLP

1900 K Street, NW

Washington, DC 20006

Telephone: (202) 261-3300 | | Joshua Wechsler, Esq.

Fried, Frank, Harris, Shriver & Jacobson LLP

One New York Plaza

New York, New York 10004

Telephone: (212) 859-8000 |

Approximate Date of Commencement of Proposed Public Offering: As soon as practicable after the effective date of this Registration Statement.

o Check box if the only securities being registered on this Form are being offered pursuant to dividend or interest reinvestment plans.

o Check box if any securities being registered on this Form will be offered on a delayed or continuous basis in reliance on Rule 415 under the Securities Act of 1933 (the “Securities Act”), other than securities offered in connection with a dividend reinvestment plan.

o Check box if this Form is a registration statement pursuant to General Instruction A.2 or a post-effective amendment thereto.

o Check box if this Form is a registration statement pursuant to General Instruction B or a post-effective amendment thereto that will become effective upon filing with the Commission pursuant to Rule 462(e) under the Securities Act.

o Check box if this Form is a post-effective amendment to a registration statement filed pursuant to General Instruction B to register additional securities or additional classes of securities pursuant to Rule 413(b) under the Securities Act.

It is proposed that this filing will become effective (check appropriate box):

o when declared effective pursuant to Section 8(c) of the Securities Act.

If appropriate, check the following box:

o This [post-effective] amendment designates a new effective date for a previously filed [post-effective amendment] [registration statement].

o This Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, and the Securities Act registration statement number of the earlier effective registration statement for the same offering is: ___.

o This Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, and the Securities Act registration statement number of the earlier effective registration statement for the same offering is: ___.

o This Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, and the Securities Act registration statement number of the earlier effective registration statement for the same offering is: ___.

Check each box that appropriately characterizes the Registrant:

o Registered Closed-End Fund (closed-end company that is registered under the Investment Company Act of 1940 (the “Investment Company Act”)).

þ Business Development Company (closed-end company that intends or has elected to be regulated as a business development company under the Investment Company Act).

o Interval Fund (Registered Closed-End Fund or a Business Development Company that makes periodic repurchase offers under Rule 23c-3 under the Investment Company Act).

o A.2 Qualified (qualified to register securities pursuant to General Instruction A.2 of this Form).

o Well-Known Seasoned Issuer (as defined by Rule 405 under the Securities Act).

o Emerging Growth Company (as defined by Rule 12b-2 under the Securities Exchange Act of 1934 (the “Exchange Act”)).

o If an Emerging Growth Company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act.

o New Registrant (registered or regulated under the Investment Company Act for less than 12 calendar months preceding this filing).

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until this Registration Statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

THE INFORMATION IN THIS PROSPECTUS IS NOT COMPLETE AND MAY BE CHANGED. WE MAY NOT SELL THESE SECURITIES UNTIL THE REGISTRATION STATEMENT FILED WITH THE SECURITIES AND EXCHANGE COMMISSION IS EFFECTIVE. THIS PROSPECTUS IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT SOLICITING AN OFFER TO BUY THESE SECURITIES IN ANY STATE WHERE THE OFFER OR SALE IS NOT PERMITTED.

SUBJECT TO COMPLETION, DATED NOVEMBER 19, 2024

PRELIMINARY PROSPECTUS

Shares

Common Stock

We are an externally managed, closed-end, non-diversified management investment company that has elected to be regulated as a business development company (“BDC”) under the Investment Company Act of 1940 (the “1940 Act”). We are managed by MSC Adviser I, LLC (the “Adviser”), a registered investment adviser under the Investment Advisers Act of 1940 (the “Advisers Act”), which is wholly-owned by Main Street Capital Corporation, a New York Stock Exchange-listed BDC.

Our principal investment objective is to maximize our investment portfolio’s total return, primarily by generating current income from our debt investments and, to a lesser extent, by generating current income and capital appreciation from our equity and equity-related investments, including warrants, convertible securities and other rights to acquire equity securities in a portfolio company. We seek to achieve our investment objective primarily by providing debt capital to private (“Private Loan”) companies owned by or in the process of being acquired by a private equity fund (our “Private Loan investment strategy”) and secondarily by providing customized long-term debt and equity capital solutions to lower middle market (“LMM”) companies (our “LMM investment strategy”). A portion of our Private Loan investments may include equity investments in our Private Loan companies. Our Private Loan investment strategy involves investments in companies that generally have annual revenues between $25 million and $500 million and annual earnings before interest, tax, depreciation and amortization expenses (“EBITDA”) between $7.5 million and $50 million. Our LMM investment strategy involves investments in companies that generally have annual revenues between $10 million and $150 million and annual EBITDA between $3 million and $20 million.

We also maintain a legacy portfolio of investments in larger middle market (“Middle Market”) companies, with annual revenues typically between $150 million and $1.5 billion (our “Middle Market investment portfolio”). Our Middle Market investments are generally debt investments in companies owned by a private equity fund that were originally issued through a syndication financing process. We have generally stopped making new Middle Market investments and expect our Middle Market investment portfolio to continue to decline in future periods as our existing Middle Market investments are repaid or sold. Our Private Loan, LMM and Middle Market investments generally range in size from $1 million to $20 million. Geographically, we maintain a diversified portfolio throughout the United States.

In contemplation of this public offering, our board of directors and the Adviser decided to shift our future investment strategy with respect to new platform investments to be solely focused on our Private Loan investment strategy. As a result, the size of our LMM investment portfolio is expected to decrease over time as we make new investments consistent with our Private Loan investment strategy and our existing LMM investments are repaid or sold in the ordinary course of business. We do, however, plan to continue executing follow on investments in our existing LMM portfolio companies going forward in accordance with our existing SEC order for co-investment exemptive relief.

Additionally, on [ • ], 2024, we effectuated a 2-for-1 reverse stock split of our outstanding common stock pursuant to approval from our board of directors (the “Reverse Stock Split”). As a result of the Reverse Stock Split, every two shares of our issued and outstanding common stock were converted into one share of issued and outstanding common stock, without any change in the par value per share. Stockholder distributions will be unchanged as any declared but unpaid distributions per share will adjust commensurate with the 2-for-1 ratio of the Reverse Stock Split. Unless otherwise indicated, all figures in this prospectus (excluding the consolidated financial statements included herein) reflect the implementation of the Reverse Stock Split.

This is a public offering of shares of our common stock. All of the shares of common stock offered by this prospectus are being sold by us.

Our board of directors has authorized an open market share repurchase program of up to $[ • ] million in the aggregate of shares of our common stock. Pursuant to the program, we may, from time to time, purchase shares of our common stock in the open market, subject to market conditions and other factors, for a 12-month period following the consummation of this offering. We will determine the timing and amount of repurchases based on our evaluation of market conditions and other factors. The repurchase program may be suspended or discontinued by us at any time. In connection with such authorization, concurrently with the closing of this offering, we intend to enter into a share repurchase plan (the “Company Rule 10b5-1 Stock Repurchase Plan”) to facilitate the repurchase of up to $[ • ] million of our shares of common stock under the share repurchase program. The repurchases of shares pursuant to the Company Rule 10b5-1 Stock Repurchase Plan will be implemented in accordance with Rule 10b5-1 and Rule 10b-18 under the Securities Exchange Act of 1934 (the “Exchange Act”). See “Prospectus Summary — Open Market Share Repurchase Program.”

Shares of our common stock have no history of public trading. We currently expect that the public offering price per share of our common stock will be $ . We expect the shares to be approved for listing on The New York Stock Exchange, subject to notice of issuance, under the symbol “MSIF”.

This prospectus contains important information you should know before investing in our common stock. Please read it before you invest and keep it for future reference. We file annual, quarterly and current reports, proxy statements and other information about us with the Securities and Exchange Commission (the “SEC”). This information will be available by written or oral request and free of charge by contacting us at MSC Income Fund, Inc., 1300 Post Oak Blvd., 8th Floor, Houston, TX 77056, on our website at www.mscincomefund.com, or by calling us collect at (713) 350-6000. The SEC also maintains a website at www.sec.gov that contains this information.

Shares of closed-end investment companies that are listed on an exchange, including BDCs, may trade at a discount to their net asset value (“NAV”) per share. The NAV per share of our common stock as of September 30, 2024 was $15.38 (as adjusted for the Reverse Stock Split on a retrospective basis). If our shares trade at a discount to our NAV, it may increase the risk of loss for purchasers in this offering. [Assuming a public offering price of $ per share, purchasers in this offering will experience immediate dilution of approximately $ per share.]

Investing in our common stock involves a high degree of risk, including credit risk and the risk of the use of leverage, and is highly speculative. The securities in which we invest generally would be rated below investment grade if they were rated by rating agencies. Below investment grade securities, which are often referred to as “junk,” have predominantly speculative characteristics with respect to the issuer’s capacity to pay interest and repay principal. They may also be difficult to value and are illiquid. Before buying any shares of our common stock, you should read the discussion of the material risks of investing in our common stock in “Risk Factors” beginning on page [42] of this prospectus. Neither the SEC nor any state securities commission, nor any other regulatory body, has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

| | | | | | | | | | | |

| | Per Share | Total |

Public offering price | | $ | $ |

Sales load (underwriting discounts and commissions)(1) | | $ | $ |

Proceeds, before expenses, to us(2) | | $ | $ |

_____________________________(1)See “Underwriting” for a more complete description of underwriting compensation.

(2)Offering expenses payable by us, exclusive of the underwriting discounts and commissions, are estimated to be approximately $ million in connection with this offering.

We granted the underwriters an option to purchase up to additional shares of our common stock from us, at the public offering price, less underwriting discounts and commissions, within 30 days from the date of this prospectus to cover over-allotments, if any. If the underwriters exercise their over-allotment option, the total sales load payable to the underwriters will be $ million, and total proceeds to us will be approximately $ million.

The shares will be delivered on or about , 2024.

| | | | | |

| RBC Capital Markets | Truist Securities |

The date of this prospectus is , 2024.

TABLE OF CONTENTS

This prospectus may contain estimates and information concerning our industry that are based on industry publications and reports. This information involves many assumptions and limitations, and you are cautioned not to give undue weight to these estimates. We have not independently verified the accuracy or completeness of the data contained in these industry publications and reports. The industry in which we operate is subject to a high degree of uncertainty and risk due to a variety of factors, including those described in the section titled “Risk Factors,” that could cause results to differ materially from those expressed in these publications and reports.

This prospectus includes summaries of certain provisions contained in the documents described in this prospectus, but reference is made to the actual documents for complete information. All of the summaries are qualified in their entirety by the actual documents. Copies of the documents referred to herein have been filed, will be filed, or will be incorporated by reference as exhibits to the registration statement of which this prospectus is a part, and you may obtain copies of those documents as described in the section titled “Available Information.”

You should rely only on the information included in this prospectus. We have not, and the underwriters have not, authorized any dealer, salesperson or other person to provide you with different information or to make representations as to matters not stated in this prospectus. We take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. If anyone provides you with different or inconsistent information, you should not rely on it. This prospectus does not constitute an offer to sell, or a solicitation of an offer to buy, any securities by any person in any jurisdiction where it is unlawful for that person to make such an offer or solicitation or to any person in any jurisdiction to whom it is unlawful to make such an offer or solicitation. You should not assume that the information included in this prospectus is accurate as of any date other than their respective dates. Changes to the information contained in this prospectus may occur after that date, and we undertake no obligation to update the information except as required by law.

The references in this prospectus to the SEC’s or our website are not intended to and do not include or incorporate by reference into this prospectus the information on those websites.

PROSPECTUS SUMMARY

This summary highlights information included elsewhere in this prospectus. It is not complete and may not contain all of the information that you should consider before making your investment decision. You should carefully read the entire prospectus, including the risks of investing in our common stock discussed in the section titled “Risk Factors” and our financial statements and related notes contained in this prospectus, and the exhibits to the registration statement of which this prospectus is a part. Any yield information contained in this prospectus related to debt investments in our investment portfolio is not intended to approximate a return on your investment in us and does not take into account other aspects of our business, including our operating and other expenses, or other costs incurred by you in connection with your investment in us. Unless otherwise noted or the context otherwise indicates, the term “MSIF” refers to MSC Income Fund, Inc., and the terms “we,” “us,” “our,” the “Company” and “MSC Income Fund” refer to MSIF and its consolidated subsidiaries, including the Taxable Subsidiaries and the Structured Subsidiaries (defined below).

MSC Income Fund

We are a principal investment firm primarily focused on providing debt capital to private (“Private Loan”) companies owned by or in the process of being acquired by a private equity fund (our “Private Loan investment strategy”) and secondarily focused on providing customized long-term debt and equity capital solutions to lower middle market (“LMM”) companies (our “LMM investment strategy”). A portion of our Private Loan investments may include equity investments in our Private Loan companies. Our portfolio investments are typically made to support leveraged buyouts, recapitalizations, growth financings, refinancings and acquisitions of companies that operate in diverse industry sectors. We seek to partner with private equity fund sponsors in our Private Loan investment strategy and primarily invest in secured debt investments of Private Loan companies generally headquartered in the United States. We maintain relationships with a diverse group of private equity fund sponsors, with no aggregate Private Loan portfolio investments with a single sponsor exceeding 13% of our total Private Loan portfolio investments at fair value as of September 30, 2024. We also seek to partner with entrepreneurs, business owners and management teams and generally provide “one-stop” debt and equity financing solutions within our LMM investment strategy. Through our LMM investment strategy, we primarily invest in secured debt investments, equity investments, warrants and other securities of LMM companies typically based in the United States.

We also maintain a legacy portfolio of investments in larger middle market (“Middle Market”) companies (our “Middle Market investment portfolio”) and a limited portfolio of other portfolio investments (“Other Portfolio”). Our Middle Market investments are generally debt investments in companies owned by a private equity fund that were originally issued through a syndication financing process. We have generally stopped making new Middle Market investments and expect our Middle Market investment portfolio to continue to decline in future periods as our existing Middle Market investments are repaid or sold. Our Other Portfolio investments primarily consist of investments that are not consistent with the typical profiles for our Private Loan, LMM or Middle Market portfolio investments, including investments in non-affiliated investment companies and private funds managed by third parties. The “Investment Portfolio,” as used herein, refers to all of our investments in Private Loan portfolio companies, investments in LMM portfolio companies, investments in Middle Market portfolio companies and Other Portfolio investments

We were formed on November 28, 2011 as a Maryland corporation to operate as an externally managed business development company (“BDC”) under the Investment Company Act of 1940, as amended (the “1940 Act”). MSIF has elected to be treated for U.S. federal income tax purposes as a regulated investment company (“RIC”) under Subchapter M of the Internal Revenue Code of 1986, as amended (the “Code”). As a result, MSIF generally does not pay corporate-level U.S. federal income taxes on any net ordinary taxable income or capital gains that it distributes to its stockholders.

On October 28, 2020, MSIF’s stockholders approved the appointment of MSC Adviser I, LLC (our “Adviser”), which is wholly-owned by Main Street Capital Corporation (“Main Street”), a New York Stock Exchange listed BDC, as MSIF’s investment adviser and administrator under an Investment Advisory and Administrative Services Agreement dated October 30, 2020 (the “Current Investment Advisory Agreement”). In such role, the Adviser has the responsibility to manage our business, including the responsibility to identify, evaluate, negotiate and structure prospective investments, make investment and portfolio management decisions, monitor our Investment Portfolio and provide ongoing administrative services.

MSIF has certain direct and indirect wholly-owned subsidiaries that have elected to be taxable entities (the “Taxable Subsidiaries”). The primary purpose of the Taxable Subsidiaries is to permit MSIF to hold equity investments in portfolio companies which are “pass-through” entities for tax purposes. MSIF also has certain direct and indirect wholly-owned subsidiaries formed for financing purposes (the “Structured Subsidiaries”).

Additionally, on [ • ], 2024, we effectuated a 2-for-1 reverse stock split of our outstanding common stock pursuant to approval from our board of directors (the “Reverse Stock Split”). As a result of the Reverse Stock Split, every two shares of our issued and outstanding common stock were converted into one share of issued and outstanding common stock, without any change in the par value per share. Stockholder distributions will be unchanged as any declared but unpaid distributions per share will adjust commensurate with the 2-for-1 ratio of the Reverse Stock Split. Unless otherwise indicated, all figures in this prospectus (excluding the consolidated financial statements included herein) reflect the implementation of the Reverse Stock Split.

Overview of Our Business

Our principal investment objective is to maximize our Investment Portfolio’s total return, primarily by generating current income from our debt investments and, to a lesser extent, by generating current income and capital appreciation from our equity and equity-related investments, including warrants, convertible securities and other rights to acquire equity securities in a portfolio company. We seek to achieve our investment objective through our Private Loan and LMM investment strategies. A portion of our Private Loan investments may include equity investments in our Private Loan companies. Our Private Loan investment strategy involves investments in companies that generally have annual revenues between $25 million and $500 million and annual earnings before interest, tax, depreciation and amortization expenses (“EBITDA”) between $7.5 million and $50 million. Our LMM investment strategy involves investments in companies that generally have annual revenues between $10 million and $150 million and annual EBITDA between $3 million and $20 million. Our Private Loan and LMM investments generally range in size from $1 million to $20 million. Geographically, we maintain a diversified portfolio throughout the United States.

Private Loan investments primarily consist of debt securities that have primarily been originated directly by our Adviser or, to a lesser extent, through our Adviser’s strategic relationships with other investment funds on a collaborative basis through investments that are often referred to in the debt markets as “club deals” because of the small lender group size. Our Private Loan investments are typically made in a company owned by or in the process of being acquired by a private equity fund. Our Private Loan portfolio debt investments are generally secured by a first priority lien on the assets of the portfolio company and typically have a term of between three and seven years from the original investment date. We may also co-invest with Main Street and the private equity funds in the equity securities of our Private Loan portfolio companies.

We seek to avoid Private Loan investments in businesses with the following characteristics: distressed situations, highly cyclical or seasonal revenues, low operating margins, high capital intensity, high customer concentration, and inexperienced management teams. Our target loan profiles for Private Loan investments typically include a total leverage level below 4.5x EBITDA, a debt-to-enterprise value below 60%, and companies with demonstrated historical cash flow generation. As of September 30, 2024 and based upon cost, our Private Loan investment portfolio generation consisted of 47.1% lead investments, which are investments where our Adviser was the lender leading the lenders’ activities on the Private Loan investment (which include, but are not limited to, sourcing the opportunity, due diligence procedures, negotiations, supervision of legal documentation and post-investment monitoring, with these activities together, the “Lender Activities”), 25.0% co-lead investments, which are investments where our Adviser was a co-lead with another lender for the Lender Activities, and 27.9% club investments, which are investments where our Adviser was not leading or co-leading the Lender Activities (excluding Private Loan investments closed by LMM investment teams, which in aggregate represent approximately 3.3% and 3.5% of our total Private Loan investment portfolio at cost and fair value, respectively, as of September 30, 2024). The portfolio company ownership within our Private Loan portfolio, based upon cost as of September 30, 2024, consisted of 97% owned by a private equity fund and 3% owned by a non-private equity fund party (excluding Private Loan investments closed by LMM investment teams). Since January 1, 2021 through September 30, 2024, our Adviser’s Private Credit investment team reviewed approximately 1,045 Private Loan investment opportunities and closed 74 investments; we participated in 73 of such investments.

We also seek to fill the financing gap for LMM businesses, which, historically, have had limited access to financing from commercial banks and other traditional sources. The underserved nature of the LMM creates the opportunity for us to meet the financing needs of LMM companies while also negotiating favorable transaction terms and equity participation. Our ability to invest across a company’s capital structure, from secured loans to equity securities, allows us to offer portfolio companies a comprehensive suite of financing options, or a “one-stop” financing solution. We believe that providing customized, “one-stop” financing solutions is important and valuable to LMM portfolio companies. We generally seek to partner directly with entrepreneurs, management teams and business owners in making our LMM investments. Our LMM portfolio debt investments are generally secured by a first lien on the assets of the portfolio company and typically have a term of between five and seven years from the original investment date. Our target purchase multiple for LMM investments is between 4.5x – 6.5x enterprise value-to-EBITDA.

In contemplation of this public offering, our board of directors and the Adviser decided to shift our future investment strategy with respect to new platform investments to be solely focused on our Private Loan investment strategy. As a result, the size of our LMM investment strategy portfolio is expected to decrease over time as we make new investments consistent with our Private Loan investment strategy and our existing LMM investment strategy investments are repaid or sold in the ordinary course of business. We do, however, plan to continue executing follow on investments in our existing LMM portfolio companies going forward in accordance with our existing SEC order for co-investment exemptive relief.

We also maintain our legacy Middle Market investment portfolio. Our Middle Market investments are generally debt investments in companies owned by private equity funds that were originally issued through a syndication financing process. We have generally stopped making new Middle Market investments and expect our Middle Market investment portfolio to continue to decline in future periods as existing Middle Market investments are repaid or sold. Our Middle Market debt investments generally range in size from $1 million to $20 million, are generally secured by a first priority lien on the assets of the portfolio company and typically have an expected duration of between three and seven years from the original investment date.

Our other portfolio (“Other Portfolio”) investments primarily consist of investments that are not consistent with the typical profiles for our Private Loan, LMM or Middle Market portfolio investments, including investments in non-affiliated investment companies and private funds managed by third parties. In our Other Portfolio, we may incur indirect fees and expenses to third party managers. Similar to our Middle Market investments, we have generally stopped making new Other Portfolio investments and expect our Other Portfolio to continue to decline in future periods as existing Other Portfolio investments are repaid or sold.

Our portfolio investments are generally made through MSIF, the Taxable Subsidiaries and the Structured Subsidiaries. MSIF, the Taxable Subsidiaries and the Structured Subsidiaries share the same investment strategies and criteria. An investor’s return in MSIF will depend, in part, on the Taxable Subsidiaries’ and the Structured Subsidiaries’ investment returns as they are wholly-owned subsidiaries of MSIF.

The level of new portfolio investment activity will fluctuate from period to period based upon our view of the current economic fundamentals, our ability to identify new investment opportunities that meet our investment criteria, and our ability to consummate the identified opportunities and our available liquidity. The level of new investment activity, and associated interest and fee income, will directly impact future investment income. In addition, the level of dividends paid by portfolio companies and the portion of our portfolio debt investments on non-accrual status will directly impact future investment income. While we intend to grow our portfolio and our investment income over the long term, our growth and our operating results may be more limited during depressed economic periods. However, we intend to appropriately manage our cost structure and liquidity position based on applicable economic conditions and our investment outlook. The level of realized gains or losses and unrealized appreciation or depreciation on our investments will also fluctuate depending upon portfolio activity, economic conditions and the performance of our individual portfolio companies. The changes in realized gains and losses and unrealized appreciation or depreciation could have a material impact on our operating results.

We have received an exemptive order from the SEC permitting co-investments among us, Main Street and other funds and clients advised by our Adviser in certain negotiated transactions where co-investing would otherwise be prohibited under the 1940 Act. We have made co-investments with, and in the future intend to continue to make co-investments with Main Street and other funds and clients advised by our Adviser, in accordance with the conditions of the order. The order requires, among other things, that we and our Adviser consider whether each such investment opportunity is appropriate for us, Main Street and the other funds and clients advised by our Adviser, as applicable, and if it is appropriate, to propose an allocation of the investment opportunity between such parties. Because our Adviser is wholly-owned by Main Street and is not managing our investment activities as its sole activity, this may provide our Adviser an incentive to allocate opportunities to Main Street, other participating funds and other clients instead of us. However, both we and our Adviser have policies and procedures in place to manage this conflict, including oversight by the independent members of our board of directors. In addition to the co-investment program described above, we also co-invest in syndicated deals and other transactions where price is the only negotiated point by us and our affiliates.

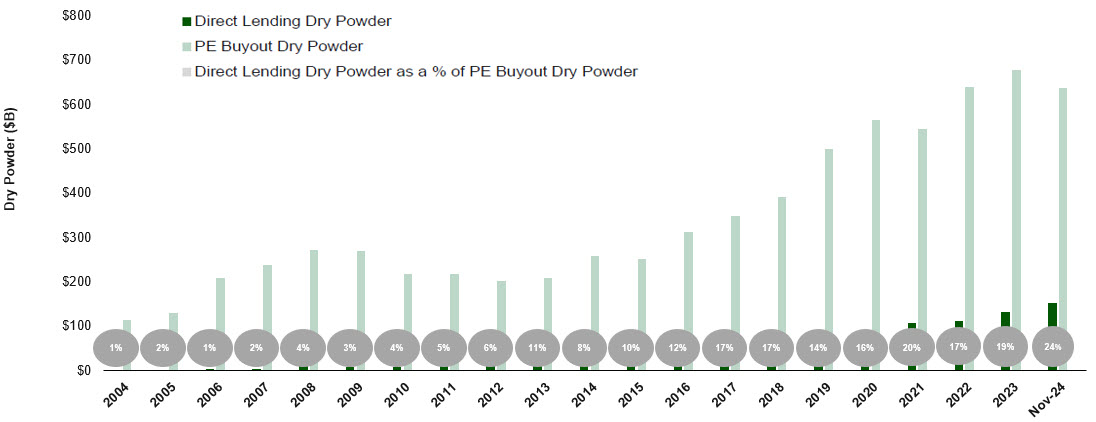

Market Opportunity

We believe that the investing environment in the markets served by our Private Loan and LMM investment strategies continues to be attractive, providing strong risk-adjusted returns due to structural and market factors. We believe that when private equity sponsors experience the flexibility of private credit financing solutions and the speed and certainty of execution, they will continue to consider financing from non-bank lenders. Additionally, we believe that our target market in our Private Loan investment strategy (companies with $7.5 million to $50 million of EBITDA) continues to be underserved. This has allowed us to establish ourselves as a “go-to” player in the space. These factors present a compelling opportunity for us to invest in quality companies on attractive terms and conditions. Certain private equity sponsors who historically sought to finance their transactions in the public, syndicated markets or with commercial banks have turned to private credit providers, including us, to finance their transactions.

Competitive Advantage

Ability to leverage the Main Street platform

We believe that our Adviser’s expertise in analyzing, valuing, structuring, negotiating and closing transactions provides us with a competitive advantage in offering customized financing solutions to companies. Main Street has a substantial network of business relationships with individuals, companies and institutions in the United States, which we believe is a consistent source of investment opportunities for us and differentiates us relative to other BDCs. Additionally, we believe that this network assists our portfolio companies through our ability to make introductions and referrals to Main Street’s key third-party relationships.

Diversified investment strategy differentiates MSC Income Fund from other investment funds

We have a U.S.-focused Private Loan investment strategy, investing primarily in senior secured, first lien loans of companies owned by, or being acquired by private equity funds. We also have a LMM investment strategy focused on investing in partnership with business owners and management teams of companies in the underserved LMM. Our core focus is sourcing investment opportunities in companies with significantly lower EBITDA versus many BDC peers, as we believe these companies are underserved from a financing standpoint. We believe the underserved nature of the market we serve results in an enhanced risk profile: including smaller lending groups, more control over underwriting, structure and documentation, and better communication and more direct interaction with the portfolio company, its management team and its private equity sponsor. Lastly, we believe that the lower leverage ratios of our portfolio companies at the time of our initial debt investment allow for greater downside protection and that the lower equity investment valuations at the time of our initial equity investment allow opportunities for higher levels of future capital appreciation. As a result of our unique investment strategies, we also have minimal portfolio company overlap versus most BDC peers, many of which have significant overlap and commonality within their investment portfolios and therefore represent common risk profiles, which we believe allows us to provide a unique investment opportunity for our investors, including the benefits of differentiation and diversification away from most BDC peers.

Experienced investment team with a strong track record

Our Adviser is served by experienced investment professionals within Main Street’s platform. Our Adviser’s investment professionals are responsible for the origination, due diligence, underwriting, structuring and monitoring of each investment throughout its life cycle. In addition, the Main Street platform includes numerous professionals focused on its legal, compliance, risk management, finance, accounting and tax functions who help support our Adviser’s investment professionals by providing guidance on our operations. As of September 30, 2024, our Adviser had 104 professionals, including 58 dedicated investment professionals, with the senior investment professionals averaging 22 years of experience and with an average of 11 years of experience at Main Street.

Stockholder alignment

As of September 30, 2024, our directors and executive officers own 0.2% of our outstanding shares of common stock, while Main Street owns 2.7% of our outstanding shares. These ownership stakes are important factors that align interests between our Adviser, management and stockholders.

Stockholder friendly cost structure

Effective upon a listing of our shares of common stock on a national securities exchange, we and the Adviser intend to amend the Current Investment Advisory Agreement to better align with our transition to focus on our Private Loan investment strategy. The changes to the Current Investment Advisory Agreement include (i) a reduction in the annual base management fees payable by us to our Adviser (with additional future contractual reductions based upon our investment portfolio composition), (ii) amendments to the structure of the subordinated incentive fee on income payable by us to our Adviser and reductions in the hurdle, catch-up percentage and incentive fee rates, including the adoption of a differentiated and stockholder friendly 50% / 50% catch-up feature, (iii) a reduction to and reset of the incentive fee on capital gains payable by us to our Adviser, (iv) establishment of a cap on the amount of expenses payable by us relating to certain internal administrative services, which varies based on the value of our total assets and (v) other changes to delete provisions required by the Omnibus Guidelines promulgated by the North American Securities Administrators Association, Inc. (“NASAA Guidelines”). We believe that our revised fee structure is among industry leaders and provides strong alignment with stockholders.

Investment Criteria

Our Adviser’s investment team has identified the following investment criteria that it believes are important in evaluating prospective portfolio companies. Our Adviser’s investment team uses these criteria in evaluating investment opportunities. However, not all of these criteria have been, or will be, met in connection with each of our investments:

•Established Companies with Positive Cash Flow. We seek to invest in established companies with sound historical financial performance. We primarily pursue investments in Private Loan companies that have historically generated annual EBITDA of $7.5 million to $50 million. We also seek to invest in LMM companies that have historically generated annual EBITDA of $3 million to $20 million. We generally do not invest in start-up companies or companies with speculative business plans.

•Defensible Competitive Advantages/Favorable Industry Position. We primarily focus on companies having competitive advantages in their respective markets and/or operating in industries with barriers to entry, which may help to protect their market position and profitability.

•Proven Management Team with Meaningful Equity Stake. We look for operationally-oriented management with direct industry experience and a successful track record. We believe management teams with these attributes are more likely to manage the companies in a manner that protects our investment.

•Exit Alternatives. We exit our debt investments primarily through the repayment of our investment from internally generated cash flow of the portfolio company and/or a refinancing. In addition, we seek to invest in companies whose business models and expected future cash flows may provide alternate methods of repaying our investment, such as through a strategic acquisition by other industry participants or a recapitalization.

Investment Portfolio

The following tables provide a summary of our investments in our Private Loan, LMM and Middle Market investment strategies as of September 30, 2024 and December 31, 2023 (excluding certain investments in Other Portfolio investments).

| | | | | | | | | | | | | | | | | |

| As of September 30, 2024 |

| Private Loan | | LMM (a) | | Middle Market |

| (dollars in millions) |

| Number of portfolio companies | 84 | | | 55 | | | 11 | |

| Fair value | $ | 679.9 | | | $ | 411.0 | | | $ | 46.1 | |

| Cost | $ | 700.0 | | | $ | 340.5 | | | $ | 73.0 | |

| Debt investments as a % of portfolio (at cost) | 95.6 | % | | 70.8 | % | | 88.9 | % |

| Equity investments as a % of portfolio (at cost) | 4.4 | % | | 29.2 | % | | 11.1 | % |

| % of debt investments at cost secured by first priority lien | 99.9 | % | | 99.9 | % | | 99.9 | % |

| Weighted-average annual effective yield (b) | 12.7 | % | | 13.2 | % | | 14.1 | % |

| Average EBITDA (c) | $ | 33.2 | | | $ | 10.0 | | | $ | 44.3 | |

_____________________________

(a)As of September 30, 2024, we had equity ownership in all of our LMM portfolio companies, and the average fully diluted equity ownership in those portfolio companies was 9%.

(b)The weighted-average annual effective yields were computed using the effective interest rates for all debt investments as of September 30, 2024, including amortization of deferred debt origination fees and accretion of original issue discount but excluding fees payable upon repayment of the debt instruments and any debt investments on non-accrual status, and are weighted based upon the principal amount of each applicable debt investment as of September 30, 2024. The weighted-average annual effective yield on our debt portfolio as of September 30, 2024 including debt investments on non-accrual status was 12.1% for our Private Loan portfolio, 11.8% for our LMM portfolio and 9.4% for our Middle Market portfolio. The weighted-average annual effective yield of our entire investment portfolio as of September 30, 2024, including debt investments on non-accrual status was 11.9%. The weighted-average annual effective yield is not reflective of what an investor in shares of our common stock will realize on its investment because it does not reflect our utilization of debt capital in our capital structure, our expenses or any sales load paid by an investor. The total return based on change in the Company’s net asset value was 6.4% (not annualized) for the nine months ended September 30, 2024. See “Financial Highlights” below.

(c)The average EBITDA is calculated using a weighted-average for the Private Loan and Middle Market portfolios and a simple average for the LMM portfolio. These calculations exclude certain portfolio companies, including two Private Loan portfolio companies, two LMM portfolio companies and one Middle Market portfolio company, as EBITDA is not a meaningful valuation metric for our investments in these portfolio companies, and those portfolio companies whose primary purpose is to own real estate and those portfolio companies whose primary operations have ceased and only residual value remains.

| | | | | | | | | | | | | | | | | |

| As of December 31, 2023 |

| Private Loan | | LMM (a) | | Middle Market |

| (dollars in millions) |

| Number of portfolio companies | 78 | | | 50 | | | 16 | |

| Fair value | $ | 595.3 | | | $ | 387.0 | | | $ | 86.0 | |

| Cost | $ | 586.4 | | | $ | 315.7 | | | $ | 114.7 | |

| Debt investments as a % of portfolio (at cost) | 94.1 | % | | 70.2 | % | | 93.1 | % |

| Equity investments as a % of portfolio (at cost) | 5.9 | % | | 29.8 | % | | 6.9 | % |

| % of debt investments at cost secured by first priority lien | 100.0 | % | | 99.9 | % | | 100.0 | % |

| Weighted-average annual effective yield (b) | 13.1 | % | | 13.0 | % | | 13.0 | % |

| Average EBITDA (c) | $ | 30.5 | | | $ | 8.8 | | | $ | 74.2 | |

_____________________________

(a)As of December 31, 2023, we had equity ownership in all of our LMM portfolio companies, and the average fully diluted equity ownership in those portfolio companies was 9%.

(b)The weighted-average annual effective yields were computed using the effective interest rates for all debt investments as of December 31, 2023, including amortization of deferred debt origination fees and accretion of original issue discount but excluding fees payable upon repayment of the debt instruments and any debt investments on non-accrual status, and are weighted based upon the principal amount of each applicable debt investment as of December 31, 2023. The weighted-average annual effective yield on our debt portfolio as of December 31, 2023 including debt investments on non-accrual status was 12.6% for our Private Loan portfolio, 13.0% for our LMM portfolio and 9.9% for our Middle Market portfolio. The weighted-average annual effective yield on our entire investment portfolio as of December 31, 2023, including debt investments on non-accrual status, was 12.4%. The weighted-average annual effective yield is not reflective of what an investor in shares of our common stock will realize on its investment because it does not reflect our utilization of debt capital in our capital structure, our expenses or any sales load paid by an investor. The total return based on change in the Company’s net asset value was 10.9% for the year ended December 31, 2023. See “Financial Highlights” below.

(c)The average EBITDA is calculated using a weighted-average for the Private Loan and Middle Market portfolios and a simple average for the LMM portfolio. These calculations exclude certain portfolio companies, including one Private Loan portfolio company, as EBITDA is not a meaningful valuation metric for our investment in this portfolio company, and those portfolio companies whose primary purpose is to own real estate.

Our Adviser and the Administrator

On October 28, 2020, our stockholders approved the appointment of the Adviser as our investment adviser and administrator under the Current Investment Advisory Agreement. In such role, our Adviser has the responsibility to manage our business, including the responsibility to identify, evaluate, negotiate and structure prospective investments, make investment and portfolio management decisions, monitor our Investment Portfolio and provide our ongoing administrative services.

Our Adviser is a wholly-owned subsidiary of Main Street, an internally managed, listed BDC whose common stock trades on the New York Stock Exchange under the ticker symbol “MAIN”. The same investment professionals who provide investment advisory services to us at the Adviser comprise the investment management team of Main Street. Main Street and the Adviser have developed a reputation in the marketplace as a responsible and efficient source of financing, which has created a stream of proprietary deal flow for us. As of September 30, 2024, Main Street has total investments with an aggregate fair value of $4.9 billion in 208 portfolio companies (including an aggregate of 193 Private Loan, LMM and Middle Market portfolio companies) and capital under management of $8.0 billion (including total assets and undrawn portions of debt capital of Main Street and clients managed by the Adviser, its wholly-owned subsidiary). As of September 30, 2024, Main Street has invested over $11.6 billion of capital since its inception. We believe that our Adviser’s expertise in analyzing, valuing, structuring, negotiating and closing transactions provides us with a competitive advantage in offering customized financing solutions to companies. Our Adviser’s investment team is responsible for identifying investment opportunities, conducting research and due diligence on prospective investments, structuring our investments and monitoring and servicing our investments. As of September 30, 2024, our Adviser’s investment team was comprised of 58 investment professionals, all of whom dedicate a substantial portion of their time to us. In addition, our Adviser had 46 dedicated operations professionals as of September 30, 2024. The Adviser believes that it has experienced support personnel, including individuals with expertise in risk management, legal, accounting, tax, information technology and compliance, among others.

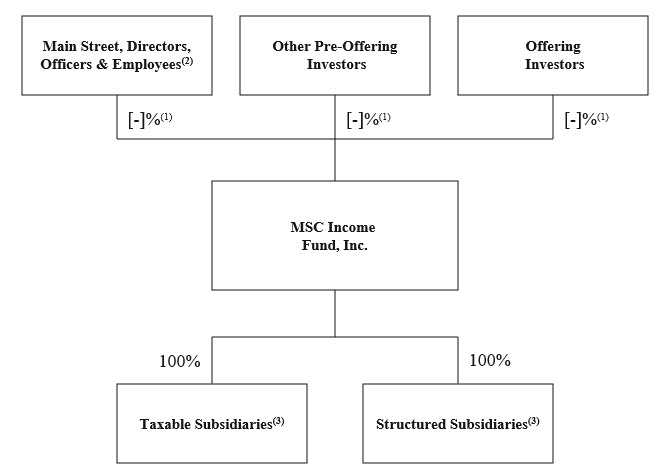

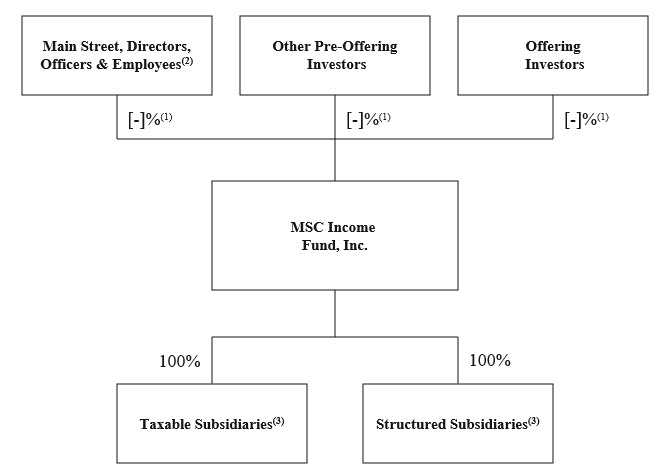

Corporate Structure

The following diagram depicts our organizational structure assuming closing of this offering:

_____________________________

(1)Assuming the underwriters do not exercise their option to purchase additional shares of common stock.

(2)Includes Main Street, certain officers and employees of Main Street and certain directors and officers of the Company.

(3)From time to time, we may form subsidiaries to facilitate our normal course of business investing activities. A “subsidiary” is an entity that primarily engages in investment activities in securities or other assets that is wholly- owned by us, including existing Taxable Subsidiaries and Structured Subsidiaries. We comply with the 1940 Act provisions governing capital structure and leverage on an aggregate basis with such wholly-owned subsidiaries, and each such subsidiary complies with the 1940 Act provisions relating to affiliated transactions and custody and is subject to the same principal investment strategies and principal risks of the Company. Any investment adviser to such wholly-owned subsidiary will comply with the provisions of the 1940 Act relating to investment advisory contract approval as if it were an investment adviser to an investment company under the 1940 Act. We do not intend to create or acquire primary control of any subsidiary that primarily engages in investment activities in securities or other assets other than entities wholly-owned by us. Each of the Taxable Subsidiaries and the Structured Subsidiaries uses the same custodians as the Company.

Current Investment Advisory Agreement and New Investment Advisory Agreement

Subject to the overall supervision of our board of directors, our Adviser oversees our day-to-day operations and provides us with investment advisory services and ongoing administrative services. Under the terms of the Current Investment Advisory Agreement and the New Investment Advisory Agreement (as defined below), our Adviser, among other things: (i) determines the composition and allocation of our Investment Portfolio, the nature and timing of any changes therein and the manner of implementing such changes; (ii) identifies, evaluates and negotiates the structure of our investments; (iii) executes and closes the acquisition of, and monitors and services, our investments; (iv) determines the securities and other assets that we purchase, retain, or sell; and (v) performs due diligence on our prospective investments and portfolio companies.

The Current Investment Advisory Agreement was most recently re-approved by our board of directors, including a majority of members who are not “interested” persons (as defined by the 1940 Act) of MSC Income Fund or the Adviser, on July 17, 2024. In connection with this offering, we intend to enter into an amended and restated investment advisory and administrative services agreement with our Adviser (the “New Investment Advisory Agreement”), which was approved by our board of directors, including a majority of members who are not “interested” persons (as defined by the 1940 Act) of the Company or the Adviser, on July 17, 2024 (and subsequently ratified at an in-person meeting on August 13, 2024). The New Investment Advisory Agreement was approved by the affirmative vote of the holders of a majority of our outstanding voting securities, as defined in the 1940 Act, at a special meeting of stockholders held on [ • ], 2024, and will be effective for an initial two-year term upon a listing of our shares of common stock on a national securities exchange (such as the New York Stock Exchange).

The New Investment Advisory Agreement, among other things, (i) reduces the annual base management fees payable by us to our Adviser, (ii) amends the structure of the subordinated incentive fee on income payable by us to our Adviser and reduces the hurdle, catch-up percentage and incentive fee rates, (iii) reduces and resets the incentive fee on capital gains payable by us to our Adviser, (iv) places a cap on the amount of expenses payable by us relating to certain internal administrative services, which varies based on the value of our total assets and (v) deletes provisions required by NASAA Guidelines.

Reduction in Base Management Fees

The New Investment Advisory Agreement reduces the annual base management fee from 1.75% of our average total assets to 1.5% of our average total assets (including cash and cash equivalents), payable quarterly in arrears. calculated based on the average value of our total assets (including cash and cash equivalents) at the end of the two most recently completed calendar quarters. The determination of total assets will reflect changes in the fair value of our portfolio investments reflecting both unrealized appreciation and unrealized depreciation.

In addition, under the New Investment Advisory Agreement, the base management fee will be further reduced to an annual rate of (i) 1.25% of the average fair value of our total assets (including cash and cash equivalents) commencing with the first full calendar quarter following the date on which the aggregate fair value of our investments in our lower middle market investment strategy (“LMM portfolio investments”) falls below 20% of our total Investment Portfolio at fair value, and (ii) 1.00% of the average fair value of our total assets (including cash and cash equivalents) commencing with the first full calendar quarter following the date on which the aggregate fair value of our LMM portfolio investments falls below 7.5% of our total Investment Portfolio at fair value.

Changes to the Subordinated Incentive Fee, Capital Gains Incentive Fee and Reduction in Hurdle and Incentive Fee Rates

The New Investment Advisory Agreement amends the structure of the subordinated incentive fee on income in a manner that expresses the “hurdle rate” required for our Adviser to earn, and be paid, the incentive fee as a percentage of our “net assets” rather than “Adjusted Capital” (as defined below).

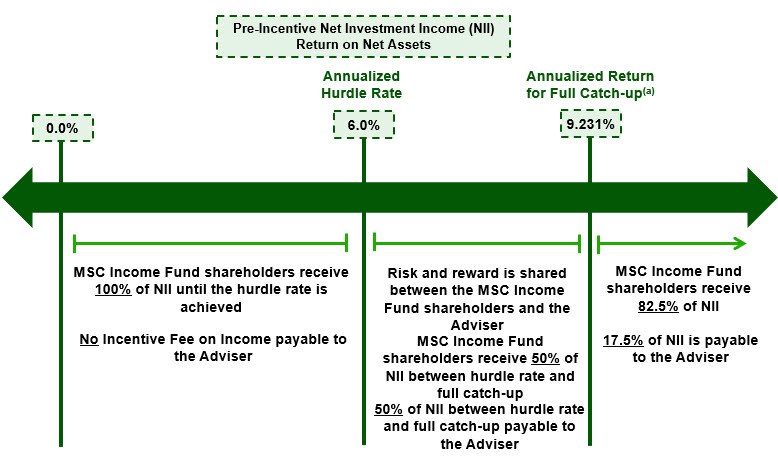

The New Investment Advisory Agreement also reduces the incentive fee rate and the hurdle rate. Under the New Investment Advisory Agreement, the subordinated incentive fee on income will be (i) reduced from 20% under the Current Investment Advisory Agreement to 17.5% and (ii) calculated and payable quarterly in arrears based on “pre-incentive fee net investment income” for the immediately preceding calendar quarter, subject to a “hurdle rate”, expressed as a rate of return on our net assets, equal to 1.5% per quarter, or an annualized rate of 6.0%. Our Adviser will receive 50% of pre-incentive fee net investment income once the hurdle rate is exceeded (decreased from 100% under the Current Investment Advisory Agreement) until the quarterly rate of 2.307692% (compared to 2.34375% under the Current Investment Advisory Agreement), or 9.230769% annualized (compared to 9.375% under the Current Investment Advisory Agreement), is exceeded, at which point our Adviser will receive 17.5% (compared to 20% under the Current Investment Advisory Agreement) of all pre-incentive fee net investment income.

“Adjusted Capital” is defined in the Current Investment Advisory Agreement to mean cumulative gross proceeds generated from sales of our common stock (including proceeds from our distribution reinvestment plan) reduced for non-liquidating distributions, other than distributions of profits, paid to our stockholders and amounts paid for share repurchases pursuant to our share repurchase program.

In addition, the New Investment Advisory Agreement reduces the incentive fee on capital gains that we are obligated to pay to our Adviser to 17.5% from 20% of our incentive fee capital gains, which will be earned on liquidated investments from our Investment Portfolio, net of any income tax expense associated with such realized capital gains. Under the New Investment Advisory Agreement, the incentive fee on capital gains will be determined and payable in arrears as of the end of each calendar year (or upon termination of the New Investment Advisory Agreement). This fee will equal (a) 17.5% of our incentive fee capital gains, which will equal our realized capital gains (net of any related income tax expense) on a cumulative basis from the effective date of the New Investment Advisory Agreement, calculated as of the end of each calendar year thereafter (or upon termination of the New Investment Advisory Agreement), computed net of (1) all realized capital losses on a cumulative basis (net of any related income tax benefit) from the effective date of the New Investment Advisory Agreement, and (2) unrealized capital depreciation (net of any related income tax benefit) on a cumulative basis from the effective date of the New Investment Advisory Agreement, less (b) the aggregate amount of any previously paid capital gain incentive fees from the effective date of the New Investment Advisory Agreement. For purposes of calculating each component of the incentive fee capital gains under the New Investment Advisory Agreement, (1) the cost basis for any investment held as of the effective date of the New Investment Advisory Agreement will be deemed to be the fair value for such investment as of the most recent quarter end immediately prior to the effective date of the New Investment Advisory Agreement and, with respect to any investment acquired subsequent to the effective date of the New Investment Advisory Agreement, the cost basis will equal the cost basis of such investment as reflected in our financial statements and (2) the income tax expense or benefit associated with all investments will be measured from the most recent quarter end immediately prior to the effective date of the New Investment Advisory Agreement through the date of any such calculation.

In addition, the subordinated incentive fee on income for any partial quarter and the incentive fee on capital gains for any partial year and quarter under the New Investment Advisory Agreement will be appropriately pro-rated.

_____________________________

(a)Annualized pre-incentive fee net investment income return at which the catch-up is fully satisfied assuming a 17.5% incentive fee on pre-incentive fee net investment income and a 50%/50% catch-up feature as prescribed in the New Investment Advisory Agreement.

Administrative Expenses and Limitations on Reimbursement for Administrative Expenses

The Current Investment Advisory Agreement includes provisions stating that we shall bear the costs and expense of our organization, operations and administration and provides that we shall either pay such costs and expenses directly, or through reimbursement to our Adviser. The Current Investment Advisory Agreement additionally outlines a number of costs and expenses relating to our day-to-day administration and management, including certain expenses related to personnel. The Adviser has historically waived reimbursement for all such “internal administrative services expenses,” except for such expenses for services that were previously provided by an external third-party that were later internalized by the Adviser. This waiver is discretionary and can be discontinued at any point in the future. Under the New Investment Advisory Agreement, this waiver is memorialized as a quarterly cap on our obligation to reimburse the Adviser for “Internal Administrative Expenses.”

“Internal Administrative Expenses” are defined under the New Investment Advisory Agreement as the actual cost of the personnel of the Adviser or its affiliates performing the functions of chief financial officer and chief compliance officer and other personnel of the Adviser or its affiliates engaged to provide day-to-day administrative and non-advisory management services or professional services for us in-house (including legal services, tax services, internal audit services, technology-related services and services in connection with compliance with federal and state laws) including, without limitation, direct compensation costs, including the allocable portion of salaries, bonuses, benefits and other direct costs associated therewith), and related overhead costs, including rent, allocated by the Adviser to us in a reasonable manner, without markup. Under the New Investment Advisory Agreement, we will not, and will not be obligated, to reimburse the Adviser for Internal Administrative Expenses in an amount that exceeds on a quarterly basis the product obtained by multiplying (x) the value of our total assets (including cash and cash equivalents) at the end of each calendar quarter by (y) the applicable “Annual Basis Point Rate” set forth in the below table:

| | | | | | | | |

| Total Assets | | Annual Basis Point Rate |

| $0 – $500 million | | 6.0 |

| Over $500 million – $1.25 billion | | 5.125 |

| Greater than $1.25 billion | | 4.5 |

Summary Principal Risk Factors

An investment in our securities, including shares of our common stock, involves a high degree of risk and may be considered speculative. The following is a summary of the principal risks that you should carefully consider before investing in our securities. Further details regarding each risk included in the below summary list can be found in “Risk Factors” beginning on page 26 of this prospectus. Risks Related to our Business and Structure

•Because our investments are recorded at fair value, there is and will continue to be uncertainty as to the value of our investments.

•We are subject to risks associated with the interest rate environment and changes in interest rates will affect our cost of capital, net investment income and the value of our investments.

•We are dependent upon our Adviser’s key investment personnel for our future success.

•Our business model depends to a significant extent upon strong referral relationships.

Risks Related to our Investments

•The types of portfolio companies in which we invest involve significant risks and we could lose all or part of our investment.

•Economic recessions or downturns could impair our portfolio companies’ performance and defaults by our portfolio companies will harm our operating results.

•Inflation could adversely affect the business, results of operations and financial condition of our portfolio companies.

•We may be exposed to higher risks with respect to our investments that include original issue discount or Payment-in-Kind (“PIK”) interest.

•The lack of liquidity in our investments may adversely affect our business.

•There may be circumstances where our debt investments could be subordinated to claims of other creditors or we could be subject to lender liability claims.

•Defaults by our portfolio companies will harm our operating results.

•We may be subject to risks associated with “covenant-lite” loans.

Risks Related to Leverage

•Because we borrow money, the potential for gain or loss on amounts invested in us is magnified and may increase the risk of investing in us.

•Substantially all of our assets are subject to security interests under our senior securities and if we default on our obligations under our senior securities, we may suffer adverse consequences, including foreclosure on our assets.

Risks Related to our Adviser and its Affiliates

•Our Adviser has conflicts of interest that may create an incentive for the Adviser to enter into investments that are riskier or more speculative than would otherwise be the case and our Adviser may have an incentive to increase portfolio leverage in order to earn higher management fees.

•Our Adviser may face conflicts of interest in allocating investment opportunities between us, Main Street and the other funds and accounts managed by our Adviser.

Risks Related to this Offering and an Investment in Shares of our Common Stock

•Investing in our shares may involve a high degree of risk.

•Prior to this offering, there has been no public market for shares of our common stock, and we cannot assure you that a market for shares of our common stock will develop or that the market price of shares of our common stock will not decline following the offering.

•We may not be able to pay distributions to our stockholders, our distributions may not grow over time, and a portion of distributions paid to our stockholders may be a return of capital.

•Purchases of shares of our common stock by us under our open market repurchase program, including the Company Rule 10b5-1 Stock Repurchase Plan, may result in the price of shares of our common stock being higher than the price that otherwise might exist in the open market.

•Sales of substantial amounts of our common stock in the public market may have an adverse effect on the market price of our common stock.

Federal Income Tax Risks

•We will be subject to corporate-level U.S. federal income tax if we are unable to qualify as a RIC under Subchapter M of the Code.

•We may have difficulty paying the distributions required to maintain RIC tax treatment under the Code if we recognize income before or without receiving cash representing such income.

Open Market Share Repurchase Program

Our board of directors authorized us to repurchase shares of our common stock through an open-market share repurchase program for up to $[ • ] million in the aggregate of shares of our common stock for a 12-month period following the consummation of this offering. Pursuant to such authorization and concurrently with the closing of this offering, we intend to enter into the Company Rule 10b5-1 Stock Repurchase Plan to acquire up to $[ • ] million in the aggregate of shares of our common stock, in accordance with the guidelines specified in Rule 10b-18 and Rule 10b5-1 of the Exchange Act.

The Company Rule 10b5-1 Stock Repurchase Plan is intended to allow us to repurchase shares of our common stock at times when we otherwise might be prevented from doing so under insider trading laws. The Company Rule 10b5-1 Stock Repurchase Plan will require our agent to repurchase shares of common stock on our behalf when the market price per share of our common stock is below the most recently reported NAV per share of our common stock by certain pre-determined levels (including any updates, corrections or adjustments publicly announced by us to any previously announced NAV per share). Under the Company Rule 10b5-1 Stock Repurchase Plan, the agent may increase the volume of purchases made as the price of our common stock declines, subject to volume restrictions.

The repurchase of shares pursuant to the Company Rule 10b5-1 Stock Repurchase Plan is intended to satisfy the conditions of Rule 10b5-1 and Rule 10b-18 under the Exchange Act and will otherwise be subject to applicable law, including Regulation M, which may prohibit purchases under certain circumstances.

The Company Rule 10b5-1 Stock Repurchase Plan will commence beginning 60 calendar days following the end of the “restricted period” under Regulation M and terminate upon the earliest to occur of (i) 12 months from the date of commencement of the Company Rule 10b5-1 Stock Repurchase Plan, (ii) the end of the trading day on which the aggregate purchase price for all shares purchased under the Company Rule 10b5-1 Stock Repurchase Plan equals $[ • ] million and (iii) the occurrence of certain other events described in the Company Rule 10b5-1 Stock Repurchase Plan.

The “restricted period” under Regulation M will end upon the closing of this offering and, therefore, the common stock repurchases/purchases described above shall not begin prior to 60 days after the closing of this offering. Under Regulation M, the restricted period could end at a later date if the underwriters were to exercise the over-allotment option to purchase shares of our common stock in excess of their short position at the time that they complete their initial distribution of shares of our common stock. In such event, the restricted period would not end until the excess securities were distributed by the underwriters or placed in their investment accounts. However, the underwriters have agreed to only exercise their over-allotment options to cover their actual short positions, if any. Therefore, the restricted period under Regulation M will end on the closing of this offering.

Company Information