mscincomefund.comMSC Income Fund, Inc. Page 1 Modified Dutch Auction Tender Offer Summary and FAQ’s August 2023 MSC Income Fund, Inc. mscincomefund.com INCOME FUND

mscincomefund.comMSC Income Fund, Inc. Page 2 Disclaimers MSC Income Fund, Inc. (MSIF or the Company) cautions that statements in this presentation that are forward-looking, and provide other than historical information, involve risks and uncertainties that may impact MSIF’s future results of operations. The forward-looking statements in this presentation are based on current conditions as of August 16, 2023, and include, but are not limited to, statements regarding MSIF’s goals, beliefs, strategies, future operating results and cash flows, operating expenses, investment originations and performance, available capital, payment and the tax attributes of future dividends, the continued repurchase of shares through the Share Repurchase Program and shareholder returns. Although the Company believes that the expectations reflected in any forward-looking statements are reasonable, the Company can give no assurance that those expectations will prove to have been correct. Those statements are made based on various underlying assumptions and are subject to numerous uncertainties and risks, including, without limitation: the Company’s continued effectiveness in raising, investing and managing capital; adverse changes in the economy generally or in the industries in which the Company’s portfolio companies operate; the impacts of macroeconomic factors on MSIF and its portfolio companies’ business and operations, liquidity and access to capital, and on the U.S. and global economies, including impacts related to pandemics and other public health crises, risk of recession, inflation, supply chain constraints or disruptions and rising interest rates; changes in laws and regulations or business, political and/or regulatory conditions that may adversely impact the Company’s operations or the operations of the Company’s portfolio companies; the operating and financial performance of the Company’s portfolio companies and their access to capital; retention of the Company’s investment adviser’s key investment personnel; competitive factors; and such other factors described under the captions “Cautionary Statement Concerning Forward-Looking Statements,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and “Risk Factors” included in the Company’s filings with the Securities and Exchange Commission (www.sec.gov), including the Company’s most recent annual report on Form 10-K and subsequently filed quarterly reports on Form 10-Q. The Company undertakes no obligation to update the information contained herein to reflect subsequently occurring events or circumstances, except as required by applicable securities laws and regulations. You should read the documents MSIF has filed with the SEC for more complete information about MSIF. You may access these documents for free by visiting EDGAR on the SEC website at www.sec.gov. These materials are also accessible on the Company’s website at www.mscincomefund.com. Information contained on the Company’s website is not incorporated by reference into this communication. The summary descriptions and other information included herein are intended only for informational purposes and convenient reference. The information contained herein is not intended to provide, and should not be relied upon for, accounting, legal or tax advice or investment recommendations. Before making an investment decision with respect to MSIF’s securities, investors are advised to carefully review any applicable offering memorandum and MSIF’s quarterly and annual reports filed with the SEC to review the risk factors described or incorporated by reference therein, and to consult with their tax, financial, investment and legal advisors.

mscincomefund.comMSC Income Fund, Inc. Page 3 MSIF Announces Modified Dutch Auction Tender Offer On August 16, 2023, the Company announced the commencement of a Modified Dutch Auction tender offer, its second such offer following the previous offer initiated on May 15, 2023, for an aggregate purchase price of not more than $3.5 million of shares of the Company’s common stock • This tender offer supplements the Company’s quarterly share repurchase program to provide an additional liquidity option to shareholders. See pages 4 – 5 for more information. • The tender offer is structured as a “Modified Dutch Auction”. See page 7 for more information. • Shares will be purchased at the lowest per share price at which the Company is able to purchase $3.5 million of shares of common stock. See page 6 for more information. • The Company will offer to buy up to $2.75 million of shares of its common stock from its stockholders in the offer. Main Street will simultaneously offer, severally and not jointly, to buy up to $0.75 million of shares from the Company’s stockholders in the offer. See pages 7 - 8 for more information. • Forms to participate in the tender are available on the Company’s website at www.mscincomefund.com/investors. • The offer will remain open until 5:00pm Central Time, September 20, 2023, unless extended or withdrawn. Documents should be submitted to the address below: Mail to: MSC Income Fund, Inc. | P.O. Box 219406 | Kansas City, MO 64121-9406 Overnight: MSC Income Fund, Inc. | 430 W. 7th St. Suite 219406 | Kansas City, MO 64105-1407

mscincomefund.comMSC Income Fund, Inc. Page 4 MSIF Announces Modified Dutch Auction Tender Offer This tender offer supplements the Company’s quarterly share repurchase program to provide an additional liquidity option to shareholders • Quarterly tender offers through the share repurchase program are made at net asset value (NAV) using a portion of the proceeds from shares issued through the Company’s dividend reinvestment plan. • These quarterly tender offers have historically been “oversubscribed” and as a result, the Company repurchases shares on a pro-rata basis from tendering shareholders, subject to “odd lot” 1 priority. (1) Accounts holding 100 shares or less.

mscincomefund.comMSC Income Fund, Inc. Page 5 MSIF Announces Modified Dutch Auction Tender Offer While this tender offer is not a full “liquidity event”, the Company views this tender offer as providing an additional liquidity option to shareholders with an increased desire for current liquidity • During the public offering process, the Company committed to seek a liquidity event for shareholders between four and six years following the closing of its continuous public offering. The public offering was closed to new investors effective September 30, 2017. • While the Company has been evaluating and continues to evaluate options for a liquidity event, recent market conditions have not presented and current market conditions do not present a favorable opportunity for such a transaction. • The Company has learned through engagement with shareholders that certain shareholders have specific needs for additional liquidity related to individual circumstances, such as death or disability of the initial holder. • The Company believes the Modified Dutch Auction tender offer is a mechanism that provides the Company the ability to offer shareholders additional flexibility in achieving full or partial liquidity.

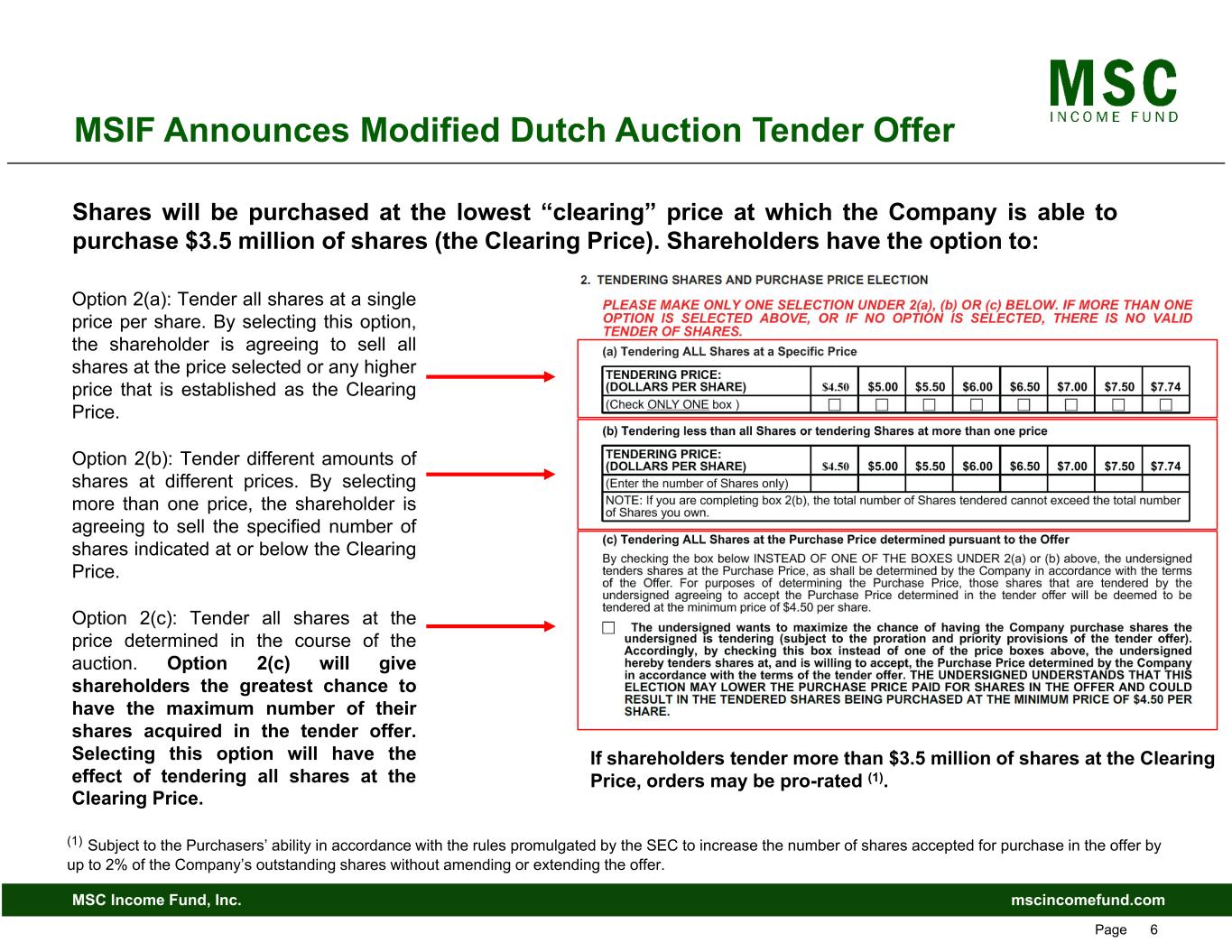

mscincomefund.comMSC Income Fund, Inc. Page 6 MSIF Announces Modified Dutch Auction Tender Offer Shares will be purchased at the lowest “clearing” price at which the Company is able to purchase $3.5 million of shares (the Clearing Price). Shareholders have the option to: Option 2(a): Tender all shares at a single price per share. By selecting this option, the shareholder is agreeing to sell all shares at the price selected or any higher price that is established as the Clearing Price. Option 2(b): Tender different amounts of shares at different prices. By selecting more than one price, the shareholder is agreeing to sell the specified number of shares indicated at or below the Clearing Price. Option 2(c): Tender all shares at the price determined in the course of the auction. Option 2(c) will give shareholders the greatest chance to have the maximum number of their shares acquired in the tender offer. Selecting this option will have the effect of tendering all shares at the Clearing Price. If shareholders tender more than $3.5 million of shares at the Clearing Price, orders may be pro-rated (1). (1) Subject to the Purchasers’ ability in accordance with the rules promulgated by the SEC to increase the number of shares accepted for purchase in the offer by up to 2% of the Company’s outstanding shares without amending or extending the offer.

mscincomefund.comMSC Income Fund, Inc. Page 7 Frequently Asked Questions Q: What is a “Modified Dutch Auction” and how does it work? A: A Modified Dutch Auction is a type of tender offer whereby the buyer solicits interest among shareholders to sell their shares at a range of prices. The process works in the opposite way as a traditional auction – sellers are asked to bid their desired sale price, resulting in a consensus sale price paid by the buyer. In this scenario, shareholders are being asked to offer to sell their shares to the purchaser at one or more prices. Once the offer period has expired, the buyer determines the Clearing Price that will enable the buyer to purchase shares up to the total amount of the offer. If the offer is oversubscribed at the Clearing Price, the buyer (i) will purchase a pro rata amount from all shareholders selling at that price(1) or (ii) may purchase a limited amount of additional shares for various reasons, including to fully purchase all shares tendered at the Clearing Price. See the following page for an example of how the Clearing Price is determined. Q: Who is offering to buy shares? A: The Company, MSC Income Fund, Inc., and Main Street Capital Corporation, the parent company to the Company’s investment adviser, together referred to herein as the Purchasers, are severally, and not jointly, offering to purchase your shares in the offer. Main Street (NYSE: MAIN) is a principal investment firm, which has elected to be regulated as a business development company under the 1940 Act, that primarily provides long-term debt and equity capital to lower middle market companies and debt capital to middle market companies. (1) Subject to the Purchasers’ ability in accordance with the rules promulgated by the SEC to increase the number of shares accepted for purchase in the offer by up to 2% of the Company’s outstanding shares without amending or extending the offer.

mscincomefund.comMSC Income Fund, Inc. Page 8 Frequently Asked Questions Q: How many shares are the Purchasers offering to buy? A: The offer is a simultaneous combined offer consisting of an offer by the Company and an offer by Main Street. Under the terms of the offer, neither the Company nor Main Street is required to purchase all of the shares. Rather, subject to the terms and conditions of the offer, the Company will severally, and not jointly, purchase, and therefore only be liable with respect to $2.75 million of shares, and Main Street will severally, and not jointly, purchase, and therefore only be liable with respect to up to $0.75 million of shares. In accordance with the rules promulgated by the SEC, the Purchasers may increase the number of shares accepted for purchase in the offer by up to 2% of the Company’s outstanding shares without amending or extending the offer. Q: How will the Purchasers pay for the shares? A: On August 1, 2023, the Company sold 348,543 shares to Main Street at $7.89 per share, the price at which the Company issued new shares in connection with reinvestments of the August 1, 2023 dividend, for total proceeds of approximately $2.75 million. The Company will use all of the proceeds from the sale of shares to Main Street to purchase shares in the offer. Main Street will use cash on hand to purchase $0.75 million of the Company’s shares. The combined total proceeds available to buy shares through the offer will be $3.5 million.

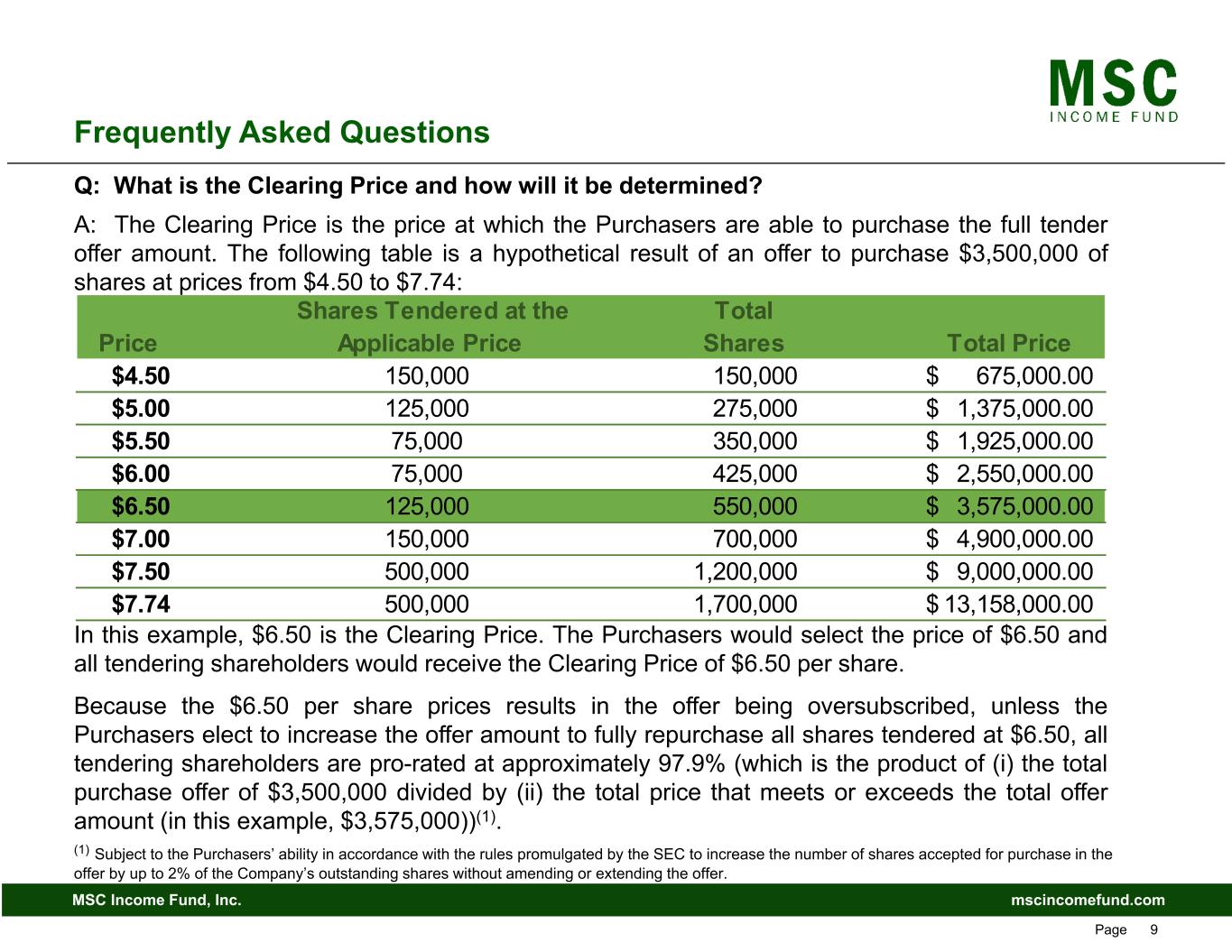

mscincomefund.comMSC Income Fund, Inc. Page 9 Frequently Asked Questions Q: What is the Clearing Price and how will it be determined? A: The Clearing Price is the price at which the Purchasers are able to purchase the full tender offer amount. The following table is a hypothetical result of an offer to purchase $3,500,000 of shares at prices from $4.50 to $7.74: In this example, $6.50 is the Clearing Price. The Purchasers would select the price of $6.50 and all tendering shareholders would receive the Clearing Price of $6.50 per share. Because the $6.50 per share prices results in the offer being oversubscribed, unless the Purchasers elect to increase the offer amount to fully repurchase all shares tendered at $6.50, all tendering shareholders are pro-rated at approximately 97.9% (which is the product of (i) the total purchase offer of $3,500,000 divided by (ii) the total price that meets or exceeds the total offer amount (in this example, $3,575,000))(1). Price Shares Tendered at the Applicable Price Total Shares Total Price $4.50 150,000 150,000 675,000.00$ $5.00 125,000 275,000 1,375,000.00$ $5.50 75,000 350,000 1,925,000.00$ $6.00 75,000 425,000 2,550,000.00$ $6.50 125,000 550,000 3,575,000.00$ $7.00 150,000 700,000 4,900,000.00$ $7.50 500,000 1,200,000 9,000,000.00$ $7.74 500,000 1,700,000 13,158,000.00$ (1) Subject to the Purchasers’ ability in accordance with the rules promulgated by the SEC to increase the number of shares accepted for purchase in the offer by up to 2% of the Company’s outstanding shares without amending or extending the offer.

mscincomefund.comMSC Income Fund, Inc. Page 10 Frequently Asked Questions Q: When will the results of the offer, including the Clearing Price, be announced? A: The Company will announce the results of the offer, including the Clearing Price as soon as possible after the expiration date for the offer, which the Company expects will be September 25, 2023. Q: If my shares are accepted in the tender offer, when will I receive payment? A: The tender offer will settle promptly after the trade date for the offer. Proceeds being distributed through a custodian or broker dealer may appear in your account several business days after payment has already been remitted. Please contact your custodian or financial professional if you do not see the proceeds from this auction in your account. Q: If I do not participate in this tender offer, what are my other liquidity options? A: Shareholders not participating in this tender offer will continue to be able to participate in the Company’s quarterly share repurchase program, any future tender offers approved by the Company and any other future liquidity events offered by the Company. While the Company continues to evaluate opportunities for a full liquidity event, the Company will also endeavor to make additional tender offers available to the extent there is available capital, shareholders continue to express an increased desire for current liquidity and subject to the discretion of the Company’s board of directors.

mscincomefund.comMSC Income Fund, Inc. Page 11 Frequently Asked Questions Q: Will I receive dividends on my shares accepted in the tender offer? A: Shareholders tendering their shares in the tender offer will no longer receive dividends having a record date after the shares are accepted for cash payment. For example, shares repurchased prior to September 29, 2023 will not receive any dividends with a record date on or after September 29, 2023. Q: If I have questions regarding the Modified Dutch Auction or the forms I need to submit in order to participate in the offer, is there someone I can speak to get my questions answered? A: Yes, please contact your financial professional directly or Hines Investor Relations at 888.220.6121 Monday through Friday from 8:00 a.m. to 5:00 p.m. CT. Hours are subject to change due to New York Stock Exchange (NYSE) schedule and holidays. Q: Whom can I contact for general information about the Company? A: Main Street Investor Relations 713-350-6000 investorservices@mscincomefund.com or visit the Company’s website at www.mscincomefund.com