HMS Income Fund, Inc.

2800 Post Oak Boulevard, Suite 5000

Houston, Texas 77056-6118

June 3, 2020

VIA EDGAR

U.S. Securities and Exchange Commission

100 F Street, N.E.

Washington, D.C. 20549-0506

Re: HMS Income Fund, Inc.

File No. 814-00939

Filing of Fidelity Bond Pursuant to Rule 17g-1

Ladies and Gentlemen:

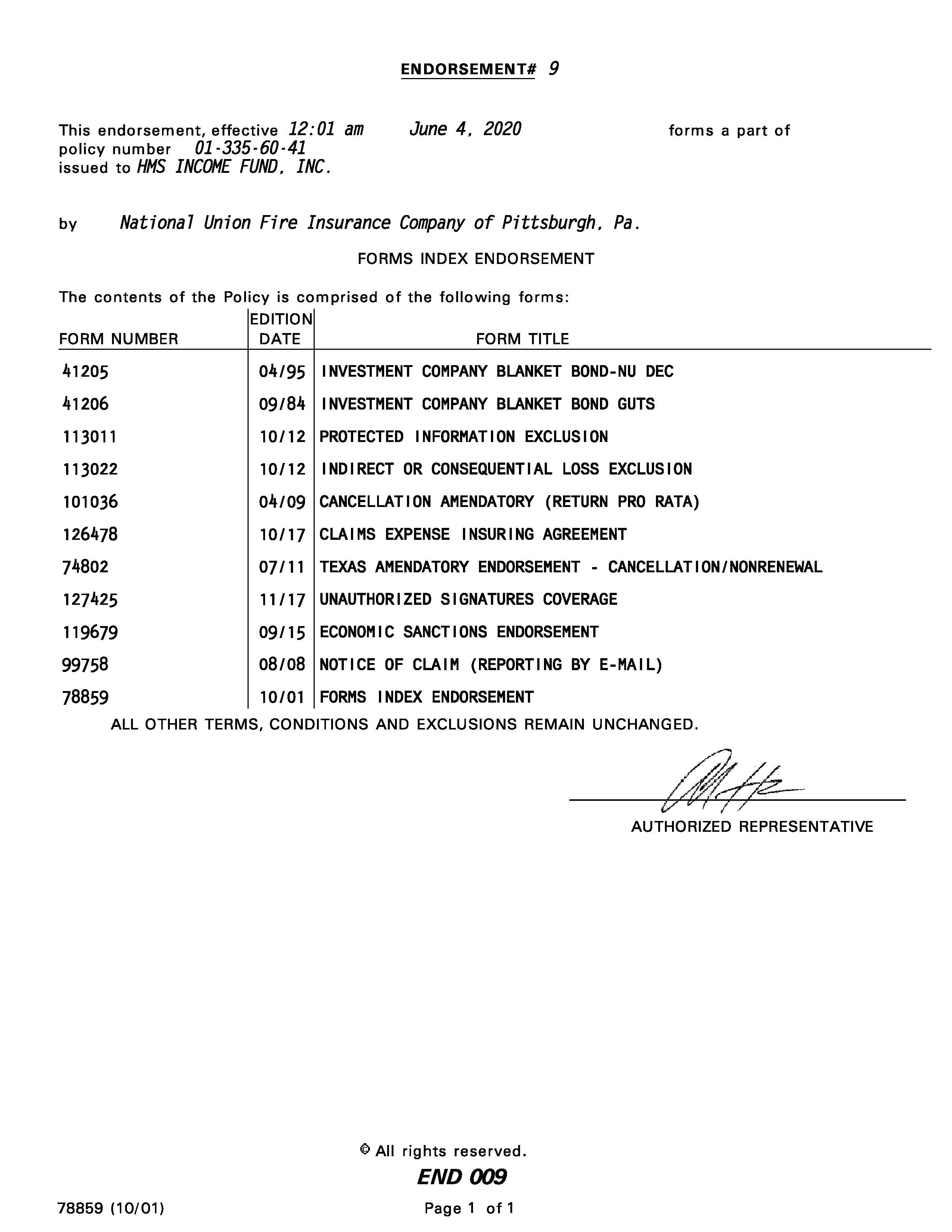

On behalf of HMS Income Fund, Inc. (the “Company”), enclosed herewith for filing pursuant to Rule 17g-1(g) under the Investment Company Act of 1940, as amended (the "1940 Act"), is a copy of the following materials:

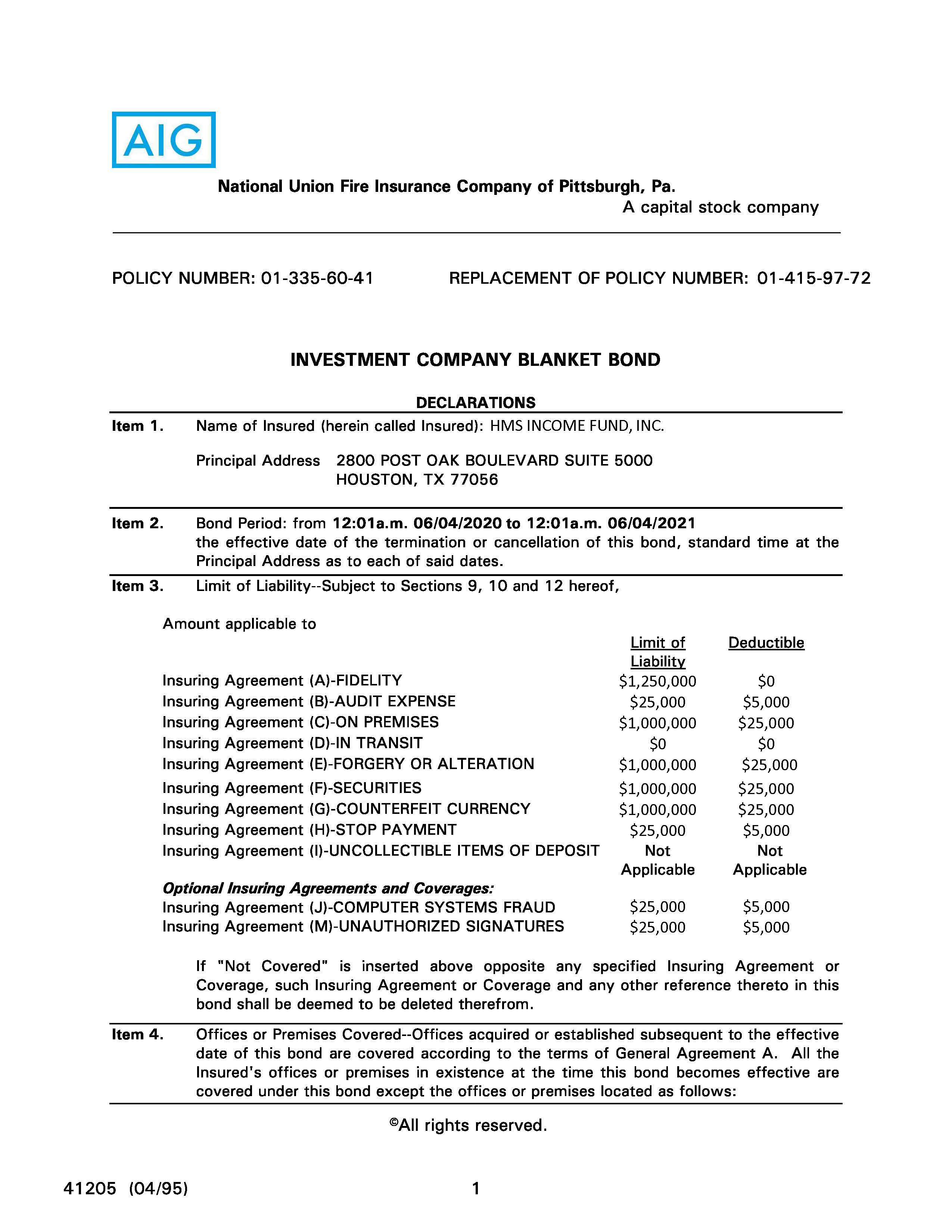

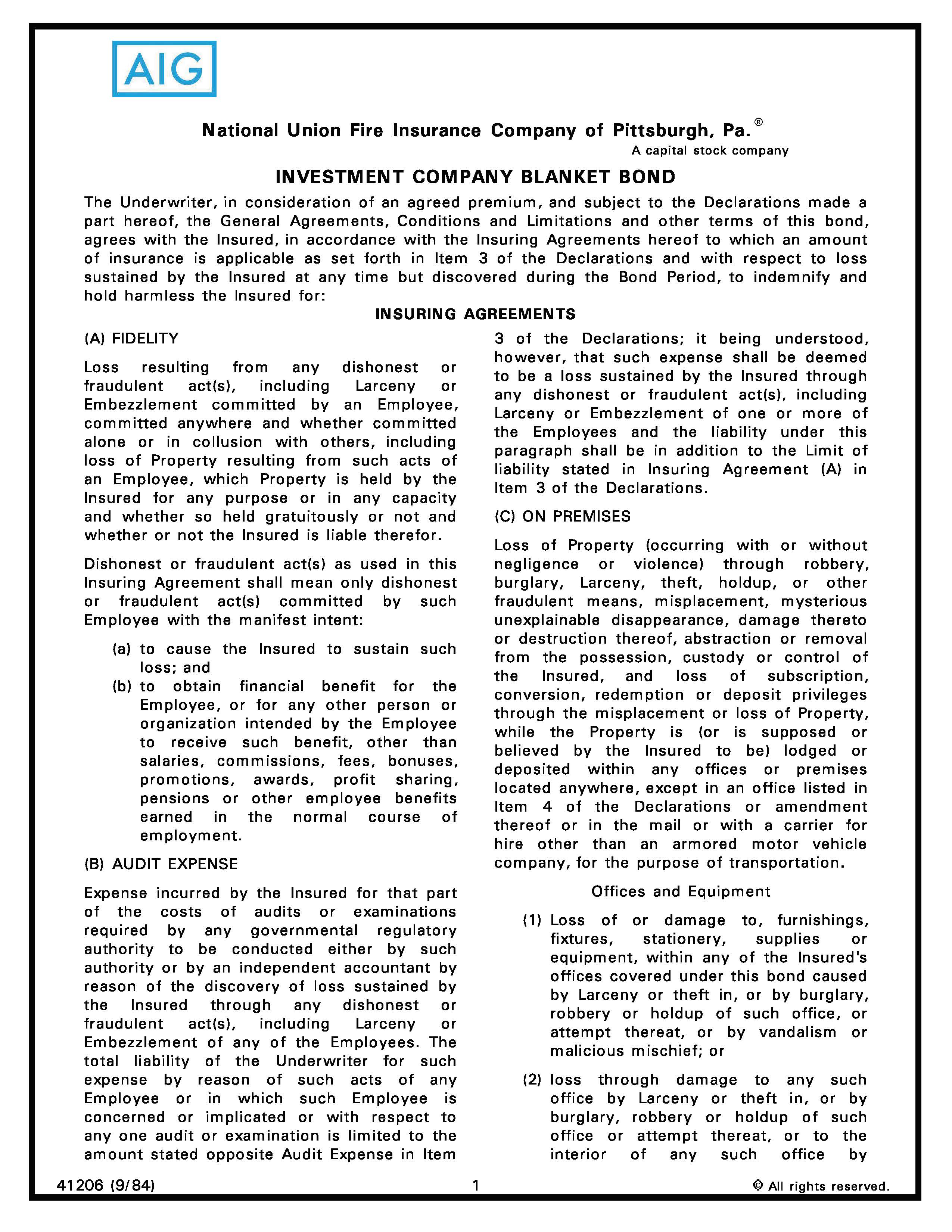

1. | A copy of the fidelity bond issued by National Union Fire Insurance Company of Pittsburgh, Pa. (the "Fidelity Bond") covering the Company; and |

2. | A Certificate of the Chief Financial Officer of the Company, which attaches a copy of the resolutions of the Board of Directors of the Company, including those directors that are not “interested persons” of the Company as defined in the 1940 Act, approving the amount, type, form and coverage of the Fidelity Bond and a statement as to the period for which premiums have been paid. |

If you have any questions regarding this submission, please do not hesitate to call me at (888) 220-6121.

Very truly yours, | |

/s/ David M. Covington | |

David M. Covington, Chief Financial Officer | |

HMS INCOME FUND, INC.

CERTIFICATE OF CHIEF FINANCIAL OFFICER

The undersigned, David M. Covington, the Chief Financial Officer of HMS Income Fund, Inc., a Maryland corporation (the “Company”), does hereby certify that:

1. | This certificate is being delivered to the Securities and Exchange Commission (the “SEC”) in connection with the filing of the Company’s fidelity bond (the “Bond”) pursuant to Rule 17g-1 of the Investment Company Act of 1940, as amended, and the SEC is entitled to rely on this certificate for purposes of the filing. |

2. | The undersigned is the duly elected, qualified and acting Chief Financial Officer of the Company and is a proper officer to make this certification. |

3. | Attached hereto as Exhibit A is a copy of the resolutions approved by the Board of Directors of the Company, including a majority of the members of the Board of Directors who are not “interested persons” of the Company, approving the amount, type, form and coverage of the Bond. |

4. | Premiums for the Bond have been paid for the period June 4, 2020 to June 4, 2021. |

IN WITNESS WHEREOF, I have executed this certificate as of this 3rd day of June, 2020.

HMS Income Fund, Inc. | ||

By: | /s/ David M. Covington | |

Name: | David M. Covington | |

Title: | Chief Financial Officer | |

EXHIBIT A

RESOLUTION FOR MEETING

OF THE BOARD OF DIRECTORS (THE “BOARD”) OF

HMS INCOME FUND, INC. (THE “COMPANY”)

HELD MAY 11, 2020

Fidelity Bonding

WHEREAS, Section 17(g) of the Investment Company Act of 1940, as amended (the “1940 Act”), and Rule 17g-1(a) thereunder require the Company, as a business development company (“BDC”), to provide and maintain a bond (the “Fidelity Bond”) that is issued by a reputable fidelity insurance company, authorized to do business in the place where the Fidelity Bond is issued, to protect the Company against larceny and embezzlement, covering each officer and employee of the Company, who may singly, or jointly with others, have access to the securities or funds of the Company, either directly or through authority to draw upon such funds of, or to direct generally, the disposition of such securities, unless the officer or employee has such access solely through his position as an officer or employee of a bank (each, a “covered person”);

WHEREAS, Rule 17g-1 requires that a majority of the members of the Board who are not “interested persons” (as defined in the 1940 Act) of the Company (the “Non-Interested Directors”) approve periodically (but not less than once every 12 months) the reasonableness of the form and amount of the Fidelity Bond, with due consideration to the value of the aggregate assets of the Company to which any covered person may have access, the type and terms of the arrangements made for the custody and safekeeping of such assets, and the nature of securities and other investments held by the Company, and pursuant to factors contained in Rule 17g-1;

WHEREAS, the Board, including all of the Non-Interested Directors, last approved the reasonableness of the form and amount of the Fidelity Bond pursuant to factors contained in Rule 17g-1 on May 10, 2019, and now desire to once again approve the reasonableness of the form and amount of the Fidelity Bond, with due consideration to the value of the aggregate assets of the Company to which any covered person may have access, the type and terms of the arrangements made for the custody and safekeeping of such assets, and the nature of securities and other investments held by the Company, and pursuant to factors contained in Rule 17g-1, based on current conditions and factors; and

WHEREAS, the Board, including all of the Non-Interested Directors, has considered the expected aggregate value of the securities and funds of the Company to which the Company’s officers and employees may have access (either directly or through authority to draw upon such funds or to direct generally the disposition of such securities), the type and terms of the arrangements made for the custody of such securities and funds, the nature of securities and other investments held by the Company, the accounting procedures and controls of the Company, the nature and method of conducting the operations of the Company, the requirements of Section 17(g) of the 1940 Act and Rule 17g-1 thereunder, and all other factors deemed relevant by the Board, including the Non-Interested Directors.

NOW, THEREFORE, BE IT RESOLVED, that having considered the foregoing factors, it is determined that the amount, type, form, premium and coverage, covering the officers and employees of the Company and insuring the Company against loss from fraudulent or dishonest acts, including larceny and embezzlement, issued by National Union Fire Insurance Company of Pittsburgh, Pa., having an aggregate coverage of $1,250,000 is reasonable, and the Fidelity Bond be, and hereby is, approved by the Board, including the Non-Interested Directors; and further

RESOLVED, that the officers of the Company be, and they hereby are, authorized to take all appropriate actions, including adjusting the terms of the Fidelity Bond as necessary, with the advice of legal counsel to the Company, to provide and maintain the Fidelity Bond on behalf of the Company; and further

RESOLVED, that any and all previous lawful actions taken by the Company’s officers, principals or agents in connection with the Fidelity Bond be, and hereby are, approved and ratified as duly authorized actions of the Company; and further

RESOLVED that the appropriate officers of the Company be, and each of them hereby is, authorized and directed, for and on behalf of the Company, to file a copy of the Fidelity Bond with the U.S. Securities and Exchange Commission (the “SEC”).