April 24, 2014

VIA EDGAR

Edward P. Bartz, Esq.

U.S. Securities & Exchange Commission

Division of Investment Management

Mailstop 4710

100 F Street, NE

Washington, DC 20549-4720

Registration Statement on Form N-2 (File No. 333-178548)

Dear Mr. Bartz:

On behalf of HMS Income Fund, Inc., a Maryland corporation (“HMS” or the “Company”), this letter responds to the comments (the “Comments”) of the staff of the Division of Investment Management (the “Staff”) of the Securities and Exchange Commission (the “Commission”) made on April 16, 2014 during a telephone conversation between Edward P. Bartz of the Staff and Tara L. Dunn of Morrison & Foerster LLP. The Comments relate to Post-Effective Amendment No. 6 to the Company’s Registration Statement on Form N-2 (File No. 333-178548) (the “Form N-2”) filed with the Commission on March 17, 2014 (“PEA No. 6”). The Comments are set forth below in italics and the Company’s responses to each Comment follow immediately therafter. Page references in the text of the Company’s responses correspond to the page numbers in Post-Effective Amendment No. 7 to the Form N-2, which is being filed with the Commission concurrently herewith (“PEA No. 7”). In addition, we include with this correspondence a blackline of pages with changes in a comparison of PEA No. 6 and PEA No. 7.

Cover Page of the Prospectus

| |

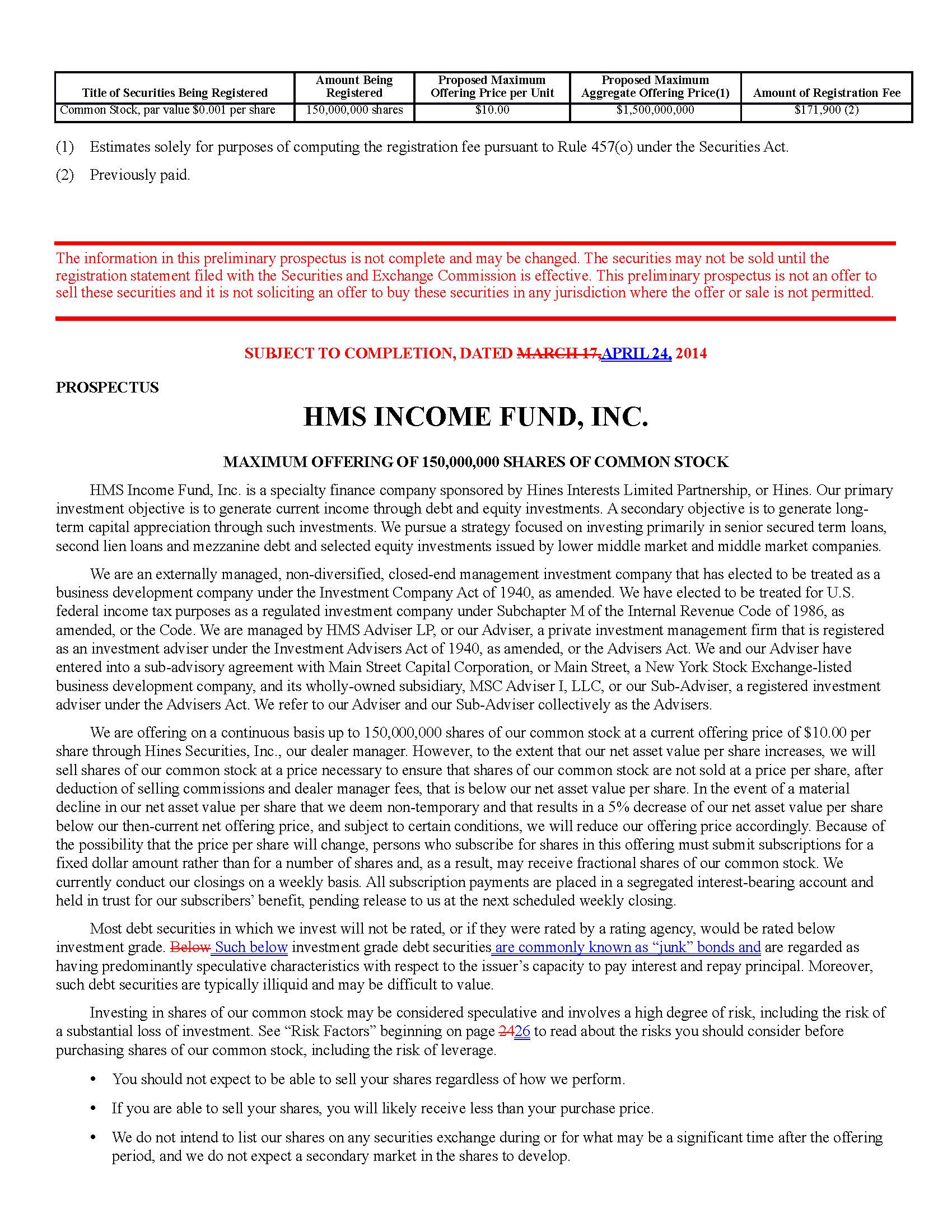

1. | Comment: In the fourth paragraph on the cover page, the Company discloses that most of the debt securities that the Company will invest in will be “below investment grade.” Please add the phrase “commonly known as “junk” bonds” to the reference to “below-investment grade.” |

Response: The Company has revised the disclosure on the cover page of PEA No. 7 to include the requested language.

Prospectus Summary - Our Company (page 1)

| |

2. | Comment: In the second full paragraph on page 1, please include the disclosure contained in the last paragraph in the section entitled “Investment Objectives and Strategy - Investments” on page 70 so to include information regarding the expected term, maturity policy and rating grade with respect to these debt securities. |

Response: The Company has revised the disclosure on page 2 of PEA No. 7 to include the requested disclosure.

Prospectus Summary - Risk Factors (pages 3-4)

| |

3. | Comment: In the summary risk factor regarding the “below investment grade” nature of most of the debt securities that the Company will invest in, please add the phrase “commonly known as “junk” bonds” to the reference to “below-investment grade.” |

Response: The Company has revised the disclosure on page 4 of PEA No. 7 to include the requested language.

| |

4. | Comment: Please include a summary risk factor regarding the possibility that in the event that the Company’s Adviser collects a fee on an investment that provides for PIK interest and such investment fails, your Adviser would not be required to repay the fee that it received with respect to that investment. PEA No. 6 includes a statement to that effect in the third full paragraph of the related risk factor on page 31. |

Response: The Company has revised the disclosure on page 4 of PEA No. 7 to include such summary risk factor.

| |

5. | Comment: Please include a summary risk factor regarding the fact that the Company’s common stock is not listed on an exchange or quoted through a quotation system and will not be listed for the foreseeable future if ever, and as a result, investors will have limited liquidity and may not receive a full return of their invested capital if they sell their shares of common stock. PEA No. 6 includes a statement to that effect in the heading to the related risk factor on page 35. |

Response: The Company has revised the disclosure on page 5 of PEA No. 7 to include such summary risk factor.

Prospectus Summary - Estimated Use of Proceeds (page 10)

| |

6. | Comment: In the first paragraph on page 10, there is a reference to the annual management fee as a percentage of the Company’s average gross assets. Please also disclose the management fee as a percentage of net assets. PEA No. 6 includes this disclosure in the table under “Fees and Expenses” on page 13. |

Response: The Company respectfully advises the Staff that it believes the current disclosure is consistent with Instruction 2 to Item 9.1.b(3) of Form N-2 which states that, “[i]f the investment advisory fee is paid in some manner other than on the basis of the average net assets, [the registrant should] briefly describe the basis of the payment.” The calculation resulting in the in the Fees and Expense table is made based upon several variables and assumptions, including those related to the size of the offering, the level of expenses and the effect of fee waivers. Thus, it may not be accurate to suggest that, as a matter of fact, that the investment advisory fee will equal 3.0% of the Company’s average net assets. The Company believes that this disclosure should be consistent with the provisions of the Investment Advisory Agreement, which requires that the base fee be calculated as a percentage of the average value of the Company’s gross assets.

Determination of Net Asset Value - Determinations in Connection With Offerings (page 72)

| |

7. | Comment: In the last bullet point in this section, please include disclosure regarding the board of directors’ responsibility for determination of net asset value pursuant to Section 2(a)(41)(B) the Investment Company Act of 1940, as amended. |

Response: The Company has revised the disclosure on pages 73-74 of PEA No. 7 to better reflect the obligation of the board of directors (or a designated committee of the board of directors) for determining fair value of the Company’s portfolio holdings.

Management - Board of Directors and Officers (pages 76-78)

| |

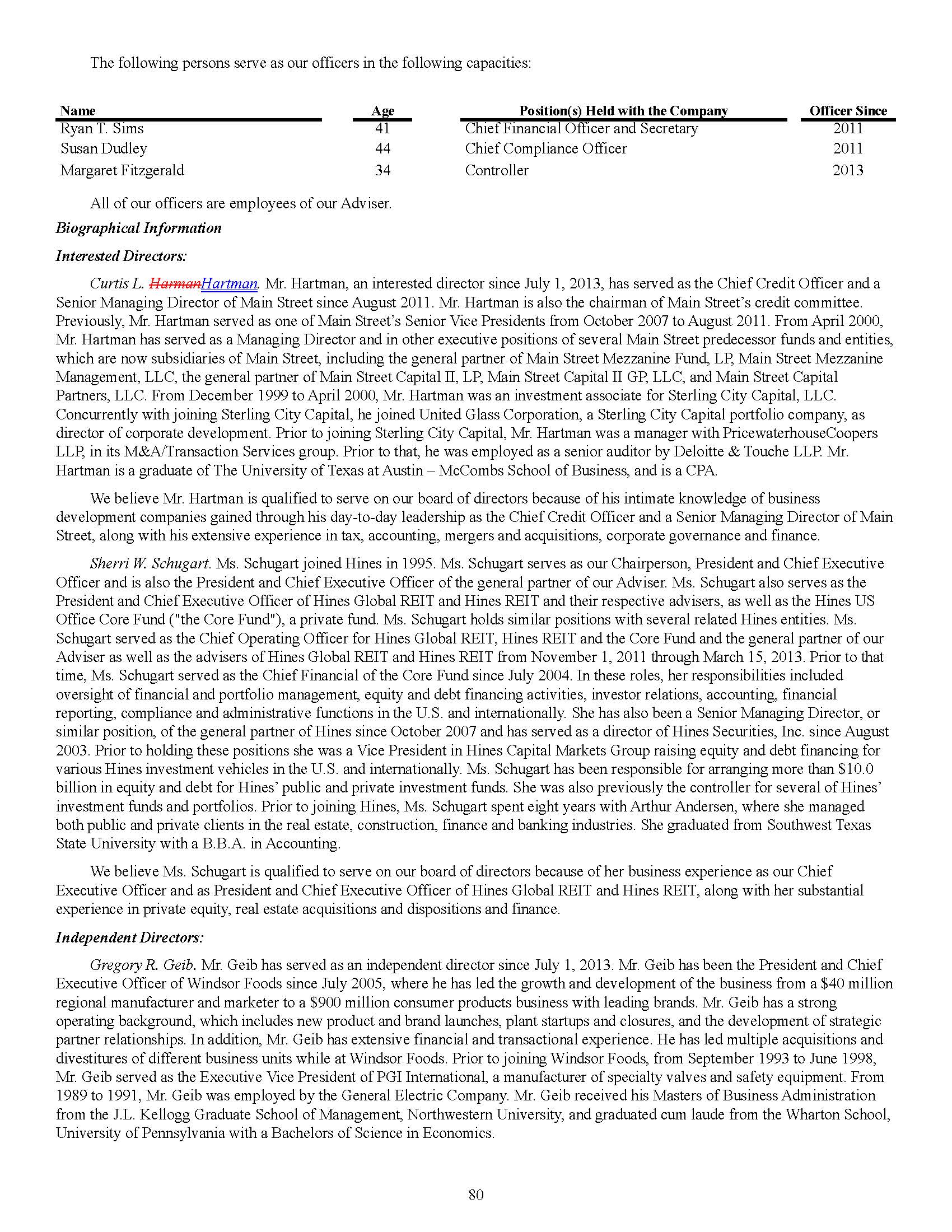

8. | Comment: In the biographical information regarding the Company’s directors, please make it clear that the disclosure includes any directorships held by directors in the past five years in any public company or registered investment company. Although the disclosure may currently be complete, please provide a statement in the lead-in to the biographical information to note that such biographical information includes, if applicable, any directorships in public companies or registered investment companies held in the past five years by each director. |

Response: The Company has revised the disclosure on page 78 of PEA No. 7 to include such clarification.

Certain Relationships and Related Party Transactions - Management and Incentive Fee Waiver (page 93)

| |

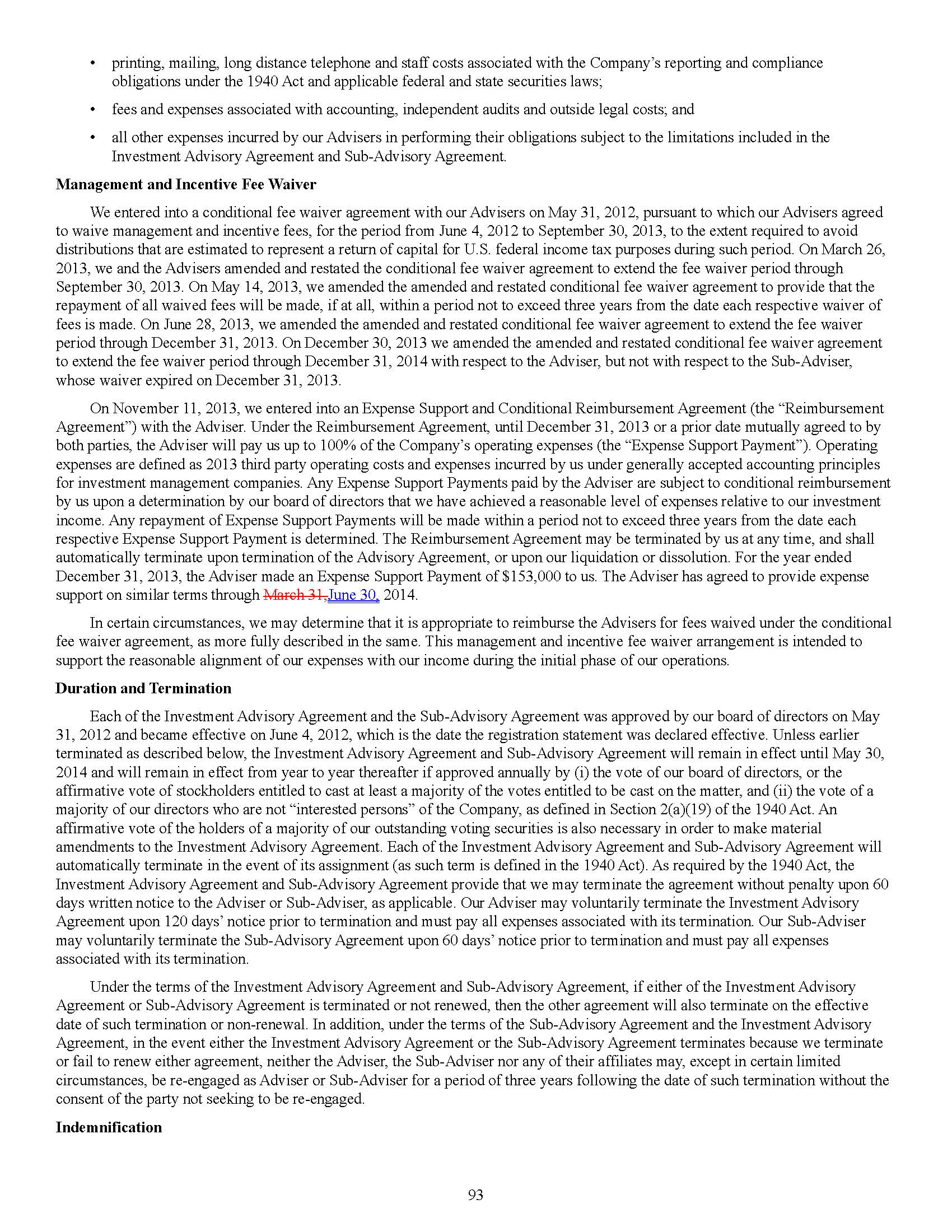

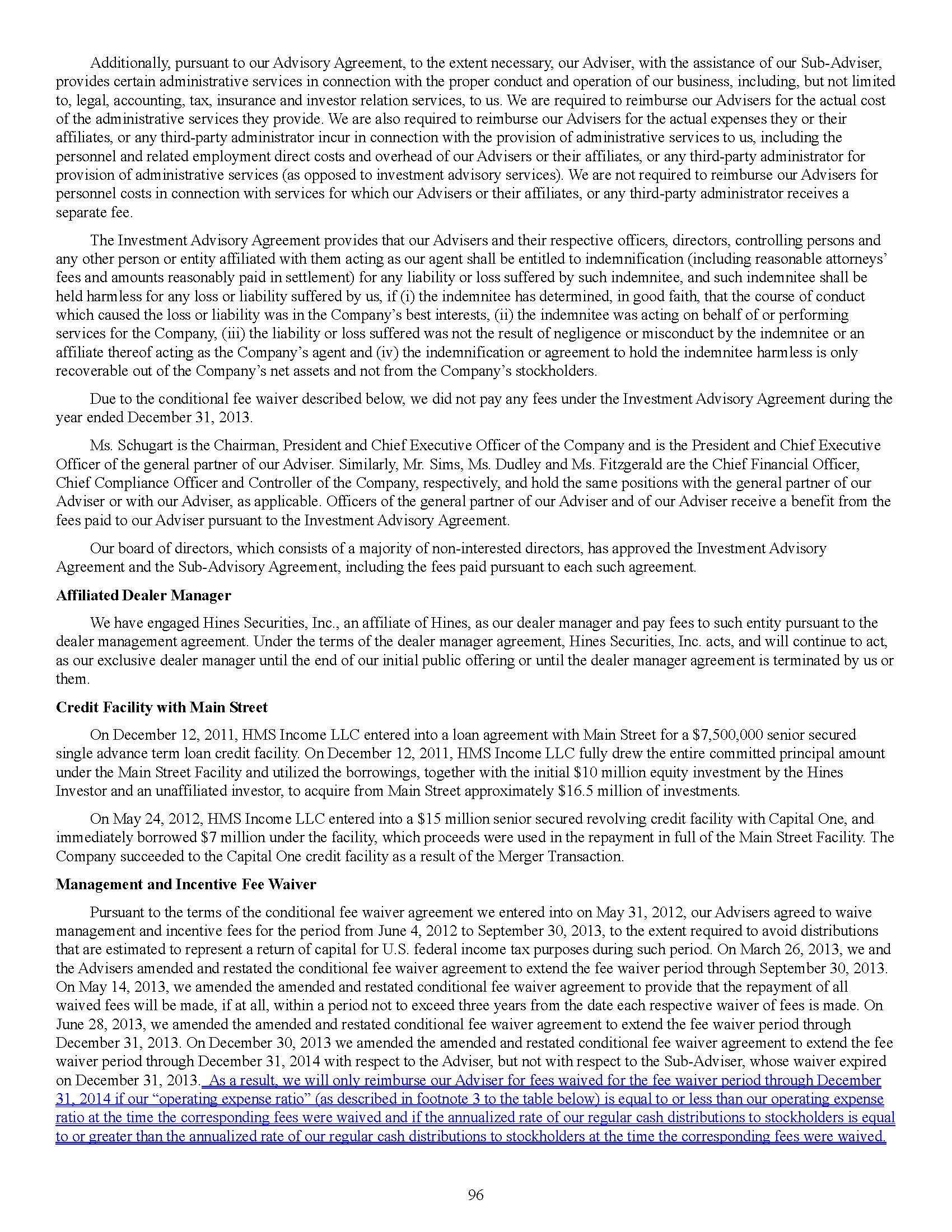

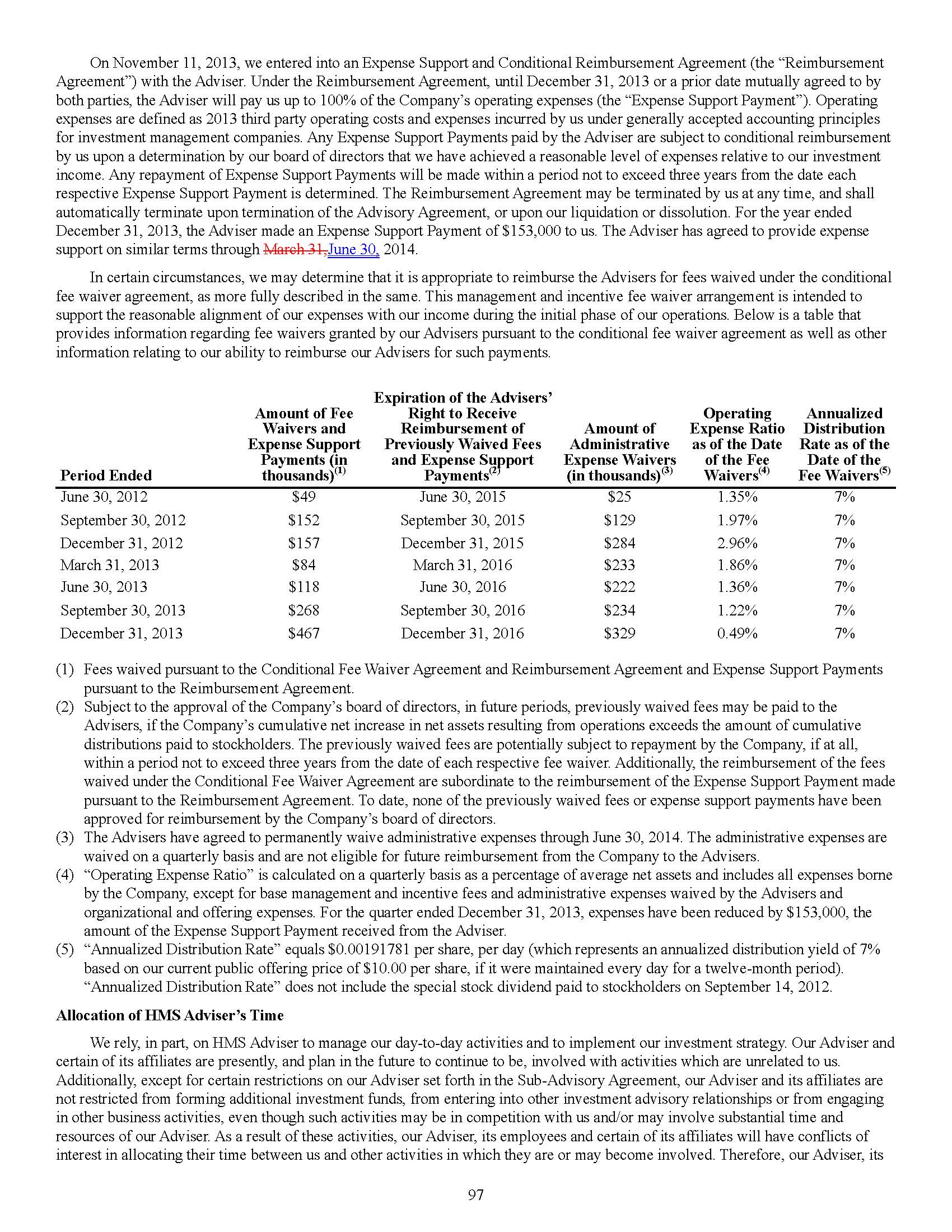

9. | Comment: In this section, please include the following language from the same section of the Company’s May 16, 2013 prospectus supplement filed pursuant to Rule 497 under the Securities Act of 1933, as amended: “In addition, we will only reimburse our Advisers for fees waived if our “operating expense ratio” (as described in footnote 3 to the table below) is equal to or less than our operating expense ratio at the time the corresponding fees were waived and if the annualized rate of our regular cash distributions to stockholders is equal to or greater than the annualized rate of our regular cash distributions to stockholders at the time the corresponding fees were waived.” In addition, in future filings with the Commission that include financial statements, please include such statement in the discussion of the management and incentive fee waiver in the notes to the financial statements. |

Response: The Company has revised the disclosure on page 95 of PEA No. 7 to include such language. Further, in response to this Comment, the Company will include such language in the discussion of the management and incentive fee waiver in the notes to the financial statements in future filings with the Commission that include financial statements.

Audited Financial Statements - Statements of Changes in Net Assets (page F-5)

| |

10. | Comment: In future filings with the Commission that include financial statements, please include the source of distributions in the Statements of Changes in Net Assets. See Regulation S-X Rule 6-09(a)3. |

Response: The Company acknowledges the Staff’s comment and respectfully advises the Staff that it has since inception disclosed in its Statement of Changes in Net Assets the sources of its distributions in accordance with Rule 6-09(a)3 of Regulation S-X. The Company respectfully advises the Staff that it has reviewed the audited financial statements of a number of BDCs and has observed that BDCs format their Statement of Changes in Net Assets in one of two ways: some, like the Company, report the individual transactions that result in changes in net assets chronologically by year in the left-hand column of the Statement and report the accounts affected across the top of the Statement, while others reflect the years affected across the top of the Statement and then report the individual transactions in the left-hand column grouped by the source of the transaction. The Company respectfully submits that Rule 6-09(a)3 does not provide a preferred format, but, as the Staff points out in its comment, requires that the issuer state separately distributions from net investment income, distributions from net realized gains and distributions from other sources. The Company has no distributions from other sources. In its Statement of Changes in Net Assets, the Company has a column for net investment income, net of dividends and a column for net realized gains, net of dividends, and reflects distributions in the appropriate column based on the source of the distribution. The Company believes this practice sufficiently separates the reporting of distributions from net investment income and from net realized gains, is consistent with the reporting by a number of both listed and unlisted BDCs and is in compliance with Rule 6-09(a)3.

Audited Financial Statements - Notes to Financial Statements - Note 5 - Financial Highlights (beginning on page F-23)

| |

11. | Comment: In future filings with the Commission that include financial statements, please include the source of distributions in the “Financial Highlights” note to the financial statements. See Item 4 of Form N-2. |

Response: In response to this Comment, the Company will provide the source of distributions in the “Financial Highlights” note to the financial statements in future filings with the Commission that include financial statements.

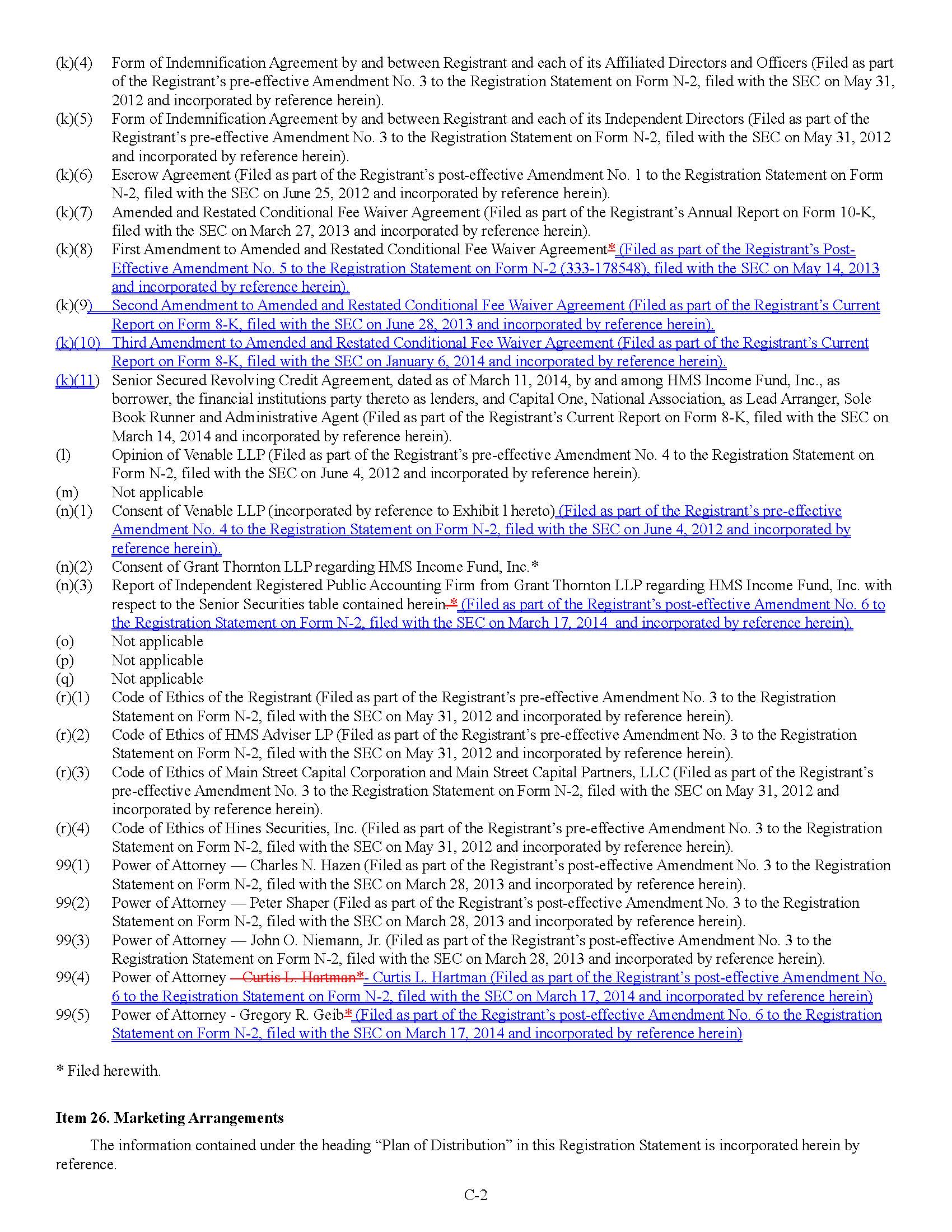

Part C - Other Information - Item 25. Financial Statements and Exhibits (page C-2)

| |

12. | Comment: We note that your exhibit table references that Exhibit (k)(8), First Amendment to Amended and Restated Conditional Fee Waiver Agreement, is filed with PEA No. 6, but that such exhibit was not filed with PEA No. 6. Please revise the exhibit table to reflect the location of such exhibit (if incorporated by reference) or file the exhibit with PEA No. 7. |

Response: The Company has revised the exhibit table in PEA No. 7.

We very much appreciate your attention to this matter. Please do not hesitate to call John Good at (202) 778-1655 or Tara L. Dunn at (303) 592-2217, if you have any questions or require any additional information.

Sincerely,

/s/ John A. Good

John A. Good

cc: Sherri W. Schugart, HMS Income Fund, Inc.