UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934 (Amendment No.)

Filed by the Registrant þ

Filed by a Party other than the Registrant

Check the appropriate box:

|

| |

| Preliminary Proxy Statement |

| Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

þ | Definitive Proxy Statement |

| Definitive Additional Materials |

| Soliciting Material Pursuant to §240.14a-12 |

HMS Income Fund, Inc.

(Name of Registrant as Specified in its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

Payment of Filing Fee (Check the appropriate box):

|

| |

þ | No fee required. |

| Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1)Title of each class of securities to which transaction applies: |

| (2)Aggregate number of securities to which transaction applies: |

| (3)Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4)Proposed maximum aggregate value of transaction: |

| (5)Total fee paid: |

| Fee paid previously with preliminary materials. |

| Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1)Amount Previously Paid: |

| (2)Form, Schedule or Registration Statement No.: |

| (3)Filing Party: |

| (4)Date Filed: |

| |

2800 Post Oak Boulevard, Suite 5000

Houston, Texas 77056-6118

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To Be Held August 5, 2014

To the stockholders of HMS Income Fund, Inc.:

I am pleased to invite our stockholders to the annual meeting of stockholders of HMS Income Fund, Inc. The annual meeting will be held at the Williams Tower Conference Center, Level 2 - Uptown Room, 2800 Post Oak Boulevard, Houston, Texas 77056 at 9:00 am, local time, on August 5, 2014. At the meeting, you will be asked to:

| |

• | elect five directors for one-year terms expiring in 2015; |

| |

• | ratify the appointment of Grant Thornton LLP as our independent registered public accounting firm; and |

| |

• | conduct such other business as may properly come before the annual meeting or any adjournment thereof. |

Our board of directors has fixed the close of business on May 7, 2014 as the record date for the determination of stockholders entitled to notice of and to vote at the meeting or any adjournment thereof. Only record holders of shares of common stock at the close of business on the record date are entitled to notice of and to vote at the annual meeting.

For further information regarding the matters to be acted upon at the annual meeting, I urge you to carefully read the accompanying proxy statement. If you have questions about these proposals or would like additional copies of the proxy statement, please contact: HMS Income Fund, Inc., Attention: Ryan T. Sims, Secretary, 2800 Post Oak Boulevard, Suite 5000, Houston, Texas 77056-6118 (telephone: (888) 220-6121).

Whether you own a few or many shares of our common stock and whether you plan to attend in person or not, it is important that your shares be voted on matters that come before the meeting. If you plan on attending the annual meeting and voting your shares in person, you will need to bring photo identification in order to be admitted to the annual meeting. To obtain directions to the annual meeting, please call us at (888) 220-6121. If you do not plan on attending the meeting and voting in person, you may vote your shares by using a toll-free telephone number or the Internet. Instructions for using these convenient services are provided on the enclosed proxy card and in the attached proxy statement. If you prefer, you may vote your shares by marking your votes on the proxy card, signing and dating it, and mailing it in the envelope provided. If you sign and return your proxy card without specifying your choices, it will be understood that you wish to have your shares voted in accordance with the recommendations of our board of directors.

You are cordially invited to attend the annual meeting. Your vote is important.

By Order of the Board of Directors

Ryan T. Sims

Chief Financial Officer and Secretary

Houston, Texas

April 24, 2014

Stockholders are requested to execute and return promptly the accompanying proxy card, which is being solicited by the board of directors of HMS Income Fund, Inc. You may execute the proxy card using the methods described in the proxy card. Executing the proxy card is important to ensure a quorum at the annual meeting. Stockholders also have the option to provide their vote by telephone or over the Internet by following the instructions printed on the proxy card. Proxies may be revoked at any time before they are exercised by submitting a written notice of revocation or a subsequently executed proxy, or by attending the annual meeting and voting in person.

Proxy Statement

TABLE OF CONTENTS

|

| |

INTRODUCTION | |

| |

INFORMATION ABOUT THE MEETING AND VOTING | |

| |

PROPOSAL ONE: ELECTION OF DIRECTORS | |

| |

General | |

| |

Nominees for the Board of Directors | |

| |

CORPORATE GOVERNANCE | |

| |

Board Leadership Structure and Role in Risk Oversight | |

| |

Committees of the Board | |

| |

Communications Between Stockholders and the Board of Directors | |

| |

Information about Executive Officers Who Are Not Directors | |

| |

Compensation Discussion and Analysis | |

| |

Code of Ethics | |

| |

Required Vote | |

| |

DIRECTOR COMPENSATION | |

| |

STOCK OWNERSHIP BY DIRECTORS, EXECUTIVE OFFICERS AND CERTAIN STOCKHOLDERS | |

| |

Ownership | |

| |

Section 16(a) Beneficial Ownership Reporting Compliance | |

| |

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS | |

| |

Our Advisers | |

| |

Management and Incentive Fee Waiver | |

| |

Allocation of our Adviser’s Time | |

| |

Allocation of the Sub-Adviser’s Time | |

| |

Affiliated Dealer Manager | |

| |

|

| |

Credit Facility with Main Street | |

| |

PROPOSAL TWO: RATIFICATION OF APPOINTMENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM | |

| |

Audit Fees | |

| |

Pre-approval Policies and Procedures | |

| |

Audit Committee Report | |

| |

Required Vote | |

| |

INVESTMENT ADVISER AND ADMINISTRATOR, INVESTMENT SUB-ADVISER AND SUB-ADMINISTRATOR AND DEALER MANAGER | |

| |

OTHER MATTERS PRESENTED FOR ACTION AT THE 2014 ANNUAL MEETING | |

| |

PRIVACY NOTICE | |

| |

STOCKHOLDER PROPOSALS FOR THE 2015 ANNUAL MEETING | |

HMS Income Fund, Inc.

2800 Post Oak Boulevard, Suite 5000

Houston, Texas 77056-6118

PROXY STATEMENT

INTRODUCTION

The accompanying proxy, mailed together with this proxy statement, is solicited by and on behalf of the board of directors of HMS Income Fund, Inc. (the “Company”) for use at the 2014 annual meeting of our stockholders and at any adjournment or postponement thereof. References in this proxy statement to “we,” “us,” “our” or like terms also refer to the Company. The mailing address of our principal executive offices is 2800 Post Oak Boulevard, Suite 5000, Houston, Texas 77056-6118. We expect to mail this proxy statement and the accompanying proxy to our stockholders of record as described below on or about May 7, 2014. Our 2013 Annual Report to Stockholders will be mailed on or about April 30, 2014.

Important Notice Regarding the Availability of Proxy Materials for the Stockholder Meeting to be Held on

August 5, 2014

This proxy statement, the form of proxy card and our annual report on Form 10-K for the year ended December 31, 2013 are available in the SEC Filings section of our website at www.hinessecurities.com/bdcs/hms-income-fund/sec-filings/. Stockholders may also obtain a copy of these materials by writing to HMS Income Fund, Inc., Attention: Ryan T. Sims, Secretary, 2800 Post Oak Boulevard, Suite 5000, Houston, Texas 77056-6118. Upon payment of a reasonable fee, stockholders may also obtain a copy of the exhibits to our Annual Report on Form 10-K for the year ended December 31, 2013.

All properly executed proxies representing shares of common stock, par value $0.001 per share, of the Company (the “Common Stock”) received prior to the annual meeting will be voted in accordance with the instructions marked thereon. If no specification is made, the shares of Common Stock will be voted “FOR” the proposal to elect each of the director nominees and “FOR” the proposal to ratify the appointment of Grant Thornton LLP (“Grant Thornton”) as the Company’s independent registered public accounting firm. Any stockholder who has given a proxy has the right to revoke it at any time prior to its exercise. Stockholders who execute proxies may revoke them with respect to a proposal by attending the annual meeting and voting his or her shares of Common Stock in person, or by submitting a letter of revocation or a later-dated proxy to the Company at the above address prior to the date of the annual meeting.

INFORMATION ABOUT THE MEETING AND VOTING

What is the date of the annual meeting and where will it be held?

Our 2014 annual meeting of stockholders (the “Annual Meeting”) will be held on August 5, 2014, at 9:00 am, local time. The Annual Meeting will be held at the Williams Tower Conference Center, Level 2 - Uptown Room, 2800 Post Oak Boulevard, Houston, Texas 77056.

What will I be voting on at the Annual Meeting?

At the Annual Meeting, you will be asked to:

| |

• | elect five directors for one-year terms expiring in 2015; |

| |

• | ratify the appointment of Grant Thornton as our independent registered public accounting firm; and |

| |

• | conduct such other business as may properly come before the Annual Meeting or any adjournment thereof. |

Our board of directors does not know of any matters that may be acted upon at the Annual Meeting other than the matters set forth in the first two bullets listed above.

Who can vote at the Annual Meeting?

The record date for the determination of holders of shares of our Common Stock entitled to notice of and to vote at the Annual Meeting, or any adjournment or postponement thereof, is the close of business on May 7, 2014. Each holder of shares

of our Common Stock issued and outstanding as of the record date is entitled to vote at the Annual Meeting. As of April 21, 2014, 10,282,950 shares of our Common Stock were outstanding.

How many votes do I have?

Each share of Common Stock has one vote on each matter considered at the Annual Meeting or any adjournment thereof. The enclosed proxy card shows the number of shares of Common Stock you are entitled to vote.

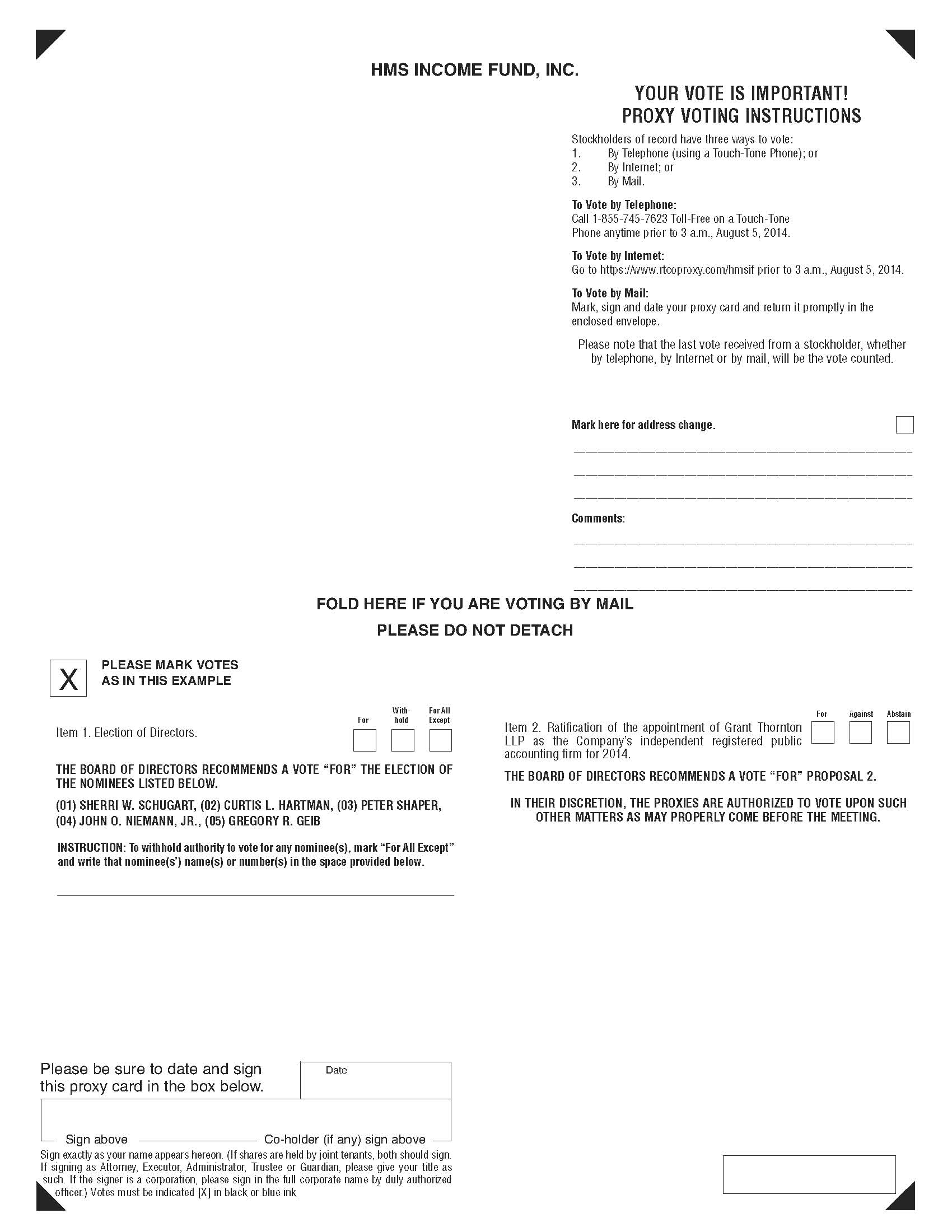

How can I vote?

You may vote in person at the Annual Meeting or by proxy. Stockholders have the following three options for submitting their votes by proxy:

| |

• | via the Internet at http://www.rtcoproxy.com/hmsif; |

| |

• | by telephone, by calling toll free 1-855-745-7623; or |

| |

• | by mail, by completing, signing, dating and returning your proxy card in the enclosed envelope. |

For those stockholders with Internet access, we encourage you to vote via the Internet, a convenient means of voting that also provides cost savings to us. In addition, when you vote via the Internet or by phone prior to the Annual Meeting date, your vote is recorded immediately and there is no risk that postal delays will cause your vote to arrive late and, therefore, not be counted. For further instructions on voting and the control number required to submit your vote via the Internet or by phone, see your proxy card enclosed with this proxy statement.

You may also vote your shares at the Annual Meeting. If you attend the Annual Meeting, you may submit your vote in person, and any previous votes that you submitted, whether by Internet, phone or mail, will be superseded by the vote that you cast at the Annual Meeting. To obtain directions to be able to attend the Annual Meeting and vote in person, please contact HMS Income Fund, Inc. Investor Relations at (888) 220-6121.

How will proxies be voted?

Shares of Common Stock represented by valid proxies will be voted at the Annual Meeting in accordance with the directions given. If the enclosed proxy card is signed and returned without any directions given, the shares will be voted “FOR” the election of the five director nominees named in the proxy and “FOR” the ratification of the appointment of Grant Thornton as our independent registered public accounting firm.

The board of directors does not intend to present, and has no information indicating that others will present, any business at the Annual Meeting other than as set forth in the attached Notice of Annual Meeting of Stockholders. However, if other matters requiring the vote of our stockholders come before the Annual Meeting, it is the intention of the persons named in the accompanying proxy card to vote the proxies held by them in accordance with their discretion on such matters.

How can I change my vote or revoke a proxy?

You have the unconditional right to revoke your proxy at any time prior to the voting thereof by submitting a later-dated proxy (either in the mail, or by telephone or the Internet), by attending the Annual Meeting and voting in person or by written notice to us addressed to: HMS Income Fund, Inc., Attention: Ryan T. Sims, Secretary, 2800 Post Oak Boulevard, Suite 5000, Houston, Texas 77056-6118. No written revocation shall be effective, however, unless and until it is received by us at or prior to the Annual Meeting.

What if I return my proxy but do not mark it to show how I am voting?

If your proxy card is signed and returned without specifying your choices, your shares will be voted as recommended by the board of directors.

What are the recommendations of the board of directors?

The board of directors recommends that you vote “FOR” the election of the five director nominees named in the proxy and “FOR” the ratification of the appointment of Grant Thornton as our independent registered public accounting firm.

What vote is required to approve each proposal?

Election of Directors. There is no cumulative voting in the election of our directors. The affirmative vote of a plurality of all of the votes cast in person or by proxy at a meeting at which a quorum is present is necessary for the election of a director. For purposes of the election of directors, abstentions and broker non-votes, if any, will not be counted as votes cast and will have no effect on the result of the vote, although they will be considered present for the purpose of determining the presence of a quorum.

Ratification of Appointment of Independent Registered Public Accounting Firm. The affirmative vote of a majority of all of the votes cast in person or by proxy at a meeting at which a quorum is present is required to ratify the appointment of Grant Thornton to serve as the Company’s independent registered public accounting firm. Abstentions will not be included in determining the number of votes cast and, as a result, will not have any effect on the result of the vote.

What constitutes a “quorum”?

The presence at the Annual Meeting, in person or represented by proxy, of the holders of a majority (greater than 50 percent) of the shares of Common Stock entitled to vote at the Annual Meeting constitutes a quorum for the transaction of business.

In the event that a quorum is not present at the Annual Meeting, the Chairman of the Annual Meeting shall have the power to adjourn the Annual Meeting from time to time to a date not more than 120 days after the original record date without notice other than the announcement at the Annual Meeting to permit further solicitation of proxies. The persons named as proxies will vote those proxies for such adjournment, unless marked to be voted against any proposal for which an adjournment is sought. Any business that might have been transacted at the Annual Meeting originally called may be transacted at any such adjourned session(s) at which a quorum is present.

If sufficient votes in favor of one or more proposals have been received by the time of the Annual Meeting, the proposals will be acted upon and such actions will be final, regardless of any subsequent adjournment to consider other proposals.

Will you incur expenses in soliciting proxies?

We will bear all costs associated with soliciting proxies for the Annual Meeting. Solicitations may be made on behalf of our board of directors by mail, personal interview, telephone or other electronic means by our officers and other employees of HMS Adviser LP (our “Adviser”), who will receive no additional compensation. We have retained Eagle Rock Proxy Advisors to aid in the solicitation of proxies. We will pay Eagle Rock Proxy Advisors a fee of approximately $5,000 in addition to variable costs related to the solicitation of proxies as well as reimbursement of its out-of-pocket expenses. We will request banks, brokers, custodians, nominees, fiduciaries and other record holders to forward copies of this proxy statement to people on whose behalf they hold shares of our Common Stock and to request authority for the exercise of proxies by the record holders on behalf of those people. In compliance with the regulations of the Securities and Exchange Commission (the “SEC”), we will reimburse such persons for reasonable expenses incurred by them in forwarding proxy materials to the beneficial owners of shares of our Common Stock.

What does it mean if I receive more than one proxy card?

Some of your shares of our Common Stock may be registered differently or held through more than one account (e.g., through different brokers or nominees). Each proxy card or voting instruction form only covers those shares of Common Stock held in the applicable account. If you hold shares of Common Stock in more than one account, you will have to provide voting instructions as to all your accounts to vote all your shares of Common Stock. If you hold your shares of our Common Stock in registered form and wish to combine your stockholder accounts in the future, you should contact HMS Income Fund, Inc. Investor Relations at 2800 Post Oak Boulevard, Suite 5000, Houston, Texas 77056-6118 or call us at (888) 220-6121. Combining accounts reduces excess printing and mailing costs, resulting in cost savings to us that benefit you as a stockholder.

What if I receive only one set of proxy materials although there are multiple stockholders at my address?

The SEC has adopted a rule concerning the delivery of documents filed by us with the SEC, including proxy statements and annual reports to stockholders. The rule allows us to, with the consent of affected stockholders, send a single set of any annual report, proxy statement, proxy statement combined with a prospectus or information statement to any household at which two or more stockholders reside. This procedure is referred to as “Householding.” This rule benefits both you and us. It

reduces the volume of duplicate information received at your household and helps us reduce expenses. Each stockholder subject to Householding will continue to receive a separate proxy card or voting instruction card.

We will promptly deliver, upon written or oral request, a separate copy of our annual report or proxy statement, as applicable, to a stockholder at a shared address to which a single copy was previously delivered. If you received a single set of disclosure documents for this year, but you would prefer to receive your own copy, you may direct requests for separate copies to HMS Income Fund, Inc. Investor Relations at 2800 Post Oak Boulevard, Suite 5000, Houston, Texas 77056-6118 or call us at (888) 220-6121. Likewise, if your household currently receives multiple copies of disclosure documents and you would like to receive one set, please contact HMS Income Fund, Inc. Investor Relations at the address or phone number above.

How do I submit a stockholder proposal for next year’s annual meeting or proxy materials, and what is the deadline for submitting a proposal?

Pursuant to our amended and restated bylaws (the “Bylaws”), in order for a stockholder proposal to be properly submitted for presentation at our 2015 annual meeting, we must receive written notice of the proposal at our executive offices during the period beginning on March 9, 2015 and ending on April 7, 2015 . In accordance with Rule 14a-8 under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), if you wish to present a proposal for inclusion in the proxy material for next year’s annual meeting, we must receive written notice of your proposal at our executive offices no later than April 7, 2015. All proposals must contain the information specified in, and otherwise comply with, our Bylaws. Proposals should be sent via registered, certified or express mail to: HMS Income Fund, Inc., 2800 Post Oak Boulevard, Suite 5000, Houston, Texas 77056-6118, Attention: Ryan T. Sims, Secretary. For additional information, see the section in this proxy statement captioned “Stockholder Proposals for the 2015 Annual Meeting.”

PROPOSAL ONE:

ELECTION OF DIRECTORS

General

The role of our board of directors is to provide general oversight of the Company’s business affairs and to exercise all of the Company’s powers except those reserved for the stockholders. The responsibilities of our board of directors also include, among other things, the oversight of the Company’s investment activities, the quarterly valuation of the Company’s assets, oversight of the Company’s financing arrangements and corporate governance activities.

Pursuant to our articles of amendment and restatement (the “Charter”) and Bylaws, the number of directors on our board of directors may not be fewer than three or greater than 15, a majority of whom must be independent. An “independent director” is defined under our Charter and means a person who is not an “interested person” as defined in Section 2(a)(19) of the Investment Company Act of 1940, as amended (the “1940 Act”). Section 2(a)(19) of the 1940 Act defines an “interested person” to include, among other things, any person who has, or within the last two years had, a material business or professional relationship with the Company. The members of the board of directors that are not independent directors are referred to as interested directors.

We currently have five directors, three of whom are independent. Generally, directors are elected annually by our stockholders, and there is no limit on the number of times a director may be elected to office. Each director serves until the next annual meeting of stockholders or (if longer) until his or her successor has been duly elected and qualified. Vacancies on the board of directors may be filled by persons elected by a majority of the remaining directors. A director elected by the board of directors to fill a vacancy shall serve until the next annual meeting of stockholders and until his or her successor is elected and qualified.

By correspondence dated February 27, 2014, Charles N. Hazen resigned as a director of the Company. On February 28, 2014, our board of directors elected Sherri W. Schugart as an interested director, effective February 28, 2014, to fill the vacancy created by Mr. Hazen’s departure. Ms. Schugart currently serves as a member of our Pricing Committee.

During 2013, our board of directors met six times and took action by unanimous written consent on three occasions. No director attended fewer than 75% of the aggregate of all meetings held during 2013 by our board of directors and by the committees on which he served. The Company encourages, but does not require, the directors to attend the Company’s annual meeting of its stockholders. We anticipate that all of our directors, each of whom has been nominated for re-election, will attend the Annual Meeting.

Nominees for the Board of Directors

If elected at the Annual Meeting, each of the director nominees set forth below would serve until the 2015 Annual Meeting of Stockholders or until his or her successor is elected and has qualified, or, if sooner, until his or her death, resignation or removal. None of the director nominees have been nominated for election pursuant to any agreement or understanding between such person and the Company. Each of the director nominees has indicated their willingness to continue to serve if elected and each has consented to be named as a nominee.

The proxy holders named on the proxy card intend to vote for the election of the five nominees listed below. The board of directors has selected these nominees on the recommendation of the Nominating and Corporate Governance Committee of the board of directors. If you do not wish your shares to be voted for particular nominees, please identify the exceptions in the designated space provided on the proxy card or, if you are voting by telephone or the Internet, follow the instructions provided when you vote. Directors will be elected by a plurality of all of the affirmative votes cast at the Annual Meeting, in person or by proxy, provided that a quorum is present or represented by proxy. Any shares not voted (whether by abstention or otherwise) have no impact on the vote.

If, by the time of the Annual Meeting, one or more of the nominees should become unable to serve, shares represented by proxies will be voted for the remaining nominees and for any substitute nominee or nominees designated by the Nominating and Corporate Governance Committee. No proxy will be voted for a greater number of persons than the number of nominees described in this proxy statement.

The following table sets forth certain information regarding the five nominees for our board of directors:

|

| | | | | | | | | |

Name, Address, Age and Position(s) with Company(1) | | Term of Office and Length of Time Served(2) | | Business Experience and Principal Occupation; Directorships in Public Corporations and Investment Companies | | Public Directorships Held by Director During the Past Five Years |

| | | | INTERESTED DIRECTORS | | |

Sherri W. Schugart (3) Age: 48 Director Nominee, Chairman, Chief Executive Officer and President | | Effective February 28, 2014 | | Ms. Schugart joined Hines Interests Limited Partnership (“Hines”), our sponsor, in 1995. Ms. Schugart serves as Chairman of our Board of Directors, and our President and Chief Executive Officer and is also the President and Chief Executive Officer of the general partner of our Adviser. Ms. Schugart also serves as the President and Chief Executive Officer of Hines Global REIT and Hines REIT and their respective advisers, as well as the Core Fund, a private fund. Ms. Schugart holds similar positions with several related Hines entities. Ms. Schugart served as the Chief Operating Officer for Hines Global REIT, Hines REIT and the Core Fund and the general partner of our Adviser as well as the advisers of Hines Global REIT and Hines REIT from November 1, 2011 through March 15, 2013. Prior to that time, Ms. Schugart served as the Chief Financial Officer of the Core Fund, Hines REIT and Hines Global REIT. She has also been a Senior Managing Director, or similar position, of the general partner of Hines since October 2007 and has served as a director of Hines Securities, Inc. since August 2003. Prior to holding these positions she was a Vice President in Hines Capital Markets Group raising equity and debt financing for various Hines investment vehicles in the U.S. and internationally. Prior to joining Hines, Ms. Schugart spent eight years with Arthur Andersen, where she managed both public and private clients in the real estate, construction, finance and banking industries. She graduated from Southwest Texas State University with a B.B.A. in Accounting.

We believe Ms. Schugart is qualified to serve on our board of directors because of her business experience as our Chief Executive Officer and as President and Chief Executive Officer of Hines Global REIT and Hines REIT, along with her substantial experience in private equity, real estate acquisitions and dispositions and finance. | | |

| | | | | | |

Curtis L. Hartman(4) Age: 41 Director Nominee | | Since 2013 | | Mr. Hartman has served as the Chief Credit Officer and a Senior Managing Director of Main Street Capital Corporation (“Main Street”), a New York Stock Exchange listed business development company, since August 2011. Mr. Hartman is also the chairman of Main Street’s credit committee and Senior Managing Director of MSC Adviser I, LLC, our Sub-Adviser. Previously, Mr. Hartman served as one of Main Street’s Senior Vice Presidents from October 2007 to August 2011. From April 2000, Mr. Hartman has served as a Managing Director and in other executive positions of several Main Street predecessor funds and entities, which are now subsidiaries of Main Street, including the general partner of Main Street Mezzanine Fund, LP, Main Street Mezzanine Management, LLC, the general partner of Main Street Capital II, LP, Main Street Capital II GP, LLC, and Main Street Capital Partners, LLC. From December 1999 to April 2000, Mr. Hartman was an investment associate for Sterling City Capital, LLC. Concurrently with joining Sterling City Capital, he joined United Glass Corporation, a Sterling City Capital portfolio company, as director of corporate development. Prior to joining Sterling City Capital, Mr. Hartman was a manager with PricewaterhouseCoopers LLP, in its M&A/Transaction Services group. Prior to that, he was employed as a senior auditor by Deloitte & Touche LLP. Mr. Hartman is a graduate of The University of Texas at Austin - McCombs School of Business, and is a CPA. We believe Mr. Hartman is qualified to serve on our board of directors because of his extensive knowledge of business development companies gained through his day-to-day leadership as the Chief Credit Officer and a Senior Managing Director of Main Street, along with his extensive experience in tax, accounting, mergers and acquisitions, corporate governance and finance. | | |

| | | | |

|

| | | | | | | | | |

| | | | INDEPENDENT DIRECTORS | | |

| | | | | | |

Peter Shaper Age: 48 Director | | Since 2012 | | Prior to founding Greenwell Energy Solutions in 2012, Mr. Shaper served as the Chief Executive Officer of CapRock Communications where he led its acquisition from McLeod in 2002 through to its sale to Harris Corporation in 2011. CapRock is a global satellite communications provider serving the energy, government and maritime industries. During his tenure, CapRock grew from a primarily domestic player with $30 million in revenue to the leading global player in its market with over $600 million in revenue. Mr. Shaper is also a founding partner of Houston-based private equity group Genesis Park. Genesis Park focuses on buyouts, partnering strategies with public corporations and growth financing bringing each company capital, commercial execution capabilities and a depth of experience in mergers and acquisitions. Previously, Mr. Shaper was the president of Donnelley Marketing, a division of First Data Corporation. He was directly responsible for the turnaround of the $100 million revenue database marketing company which led to a successful sale to a strategic buyer. In 1996, Mr. Shaper helped found the Information Management Group, or IMG, as its Executive Vice President of Operations and CFO. IMG grew to more than $600 million in revenue during his tenure. Prior to joining IMG, Mr. Shaper was with a Dallas-based private equity firm where he was responsible for investments in numerous technology-oriented companies, as well as assisting those companies with developing long-term strategies and financial structures. Mr. Shaper also has several years of experience with the international consulting firm McKinsey & Company. Mr. Shaper holds a Master of Business Administration degree from Harvard University and a Bachelor of Science in Engineering from Stanford University. Mr. Shaper currently serves on the board of directors of Greenwell Energy Solutions, Genesis Park, ipDatatel and Hines Global REIT as well as the non-profit boards of the Greater Houston Community Foundation, Prepared for Life and Knowledge Is Power Prep Schools.

We believe Mr. Shaper’s significant experience as a senior executive officer of sophisticated companies, such as Greenwell Energy Solutions, CapRock Communications, Inc., Genesis Park LP and Donnelley Marketing/First Data Corporation, as well as his experience founding and leading IMG, make him well qualified to serve on our board of directors. | | Director, Hines Global REIT |

| | | | | | |

John O. Niemann, Jr. Age: 57 Director | | Since 2012 | | Mr. Niemann served as a director and Chairman of the Audit Committee of Gateway Energy Corporation from June 2010 until December 2013 (when the company went private). Since June 2013, he has served as a Managing Director of WTAS LLC. He is also the president and chief operating officer of Arthur Andersen LLP, and has been since 2003. He previously served on the administrative board of Arthur Andersen LLP and on the board of partners of Andersen Worldwide. He began his career at Arthur Andersen LLP in 1978 and has served in increasing responsibilities in senior management positions, since 1992. Mr. Niemann has served on the board of directors of many Houston area non-profit organizations, including Strake Jesuit College Preparatory School (past chair of the board), The Regis School of the Sacred Heart (past chair of the board), The Houston Symphony, The University of St. Thomas, The Alley Theatre and Taping for the Blind, Inc. He graduated with a bachelor of arts in managerial studies (magna cum laude) and a masters in accounting from Rice University and received a juris doctor (summa cum laude) from the South Texas College of Law.

We believe Mr. Niemann’s significant experience in the public accounting industry, including 35 years in various capacities at Arthur Andersen LLP makes him well qualified to serve as one of our directors. Drawing on this experience, Mr. Niemann is able to provide valuable insights regarding our investment strategies, internal controls, and financial reporting. In addition, through his experience serving on the board of directors of another public company, Mr. Niemann has previous experience in the requirements of serving on a public company board. | | Director and Chairman of Audit Committee, Gateway Energy Corporation |

| | | | | | |

|

| | | | | | | | | |

Gregory R. Geib Age: 48 Director Nominee | | Since 2013 | | Mr. Geib has served as President and Chief Executive Officer of Windsor Foods since July 2005, where he has lead the growth and development of the business from a $40 million regional manufacturer and marketer to a $900 million consumer products business with leading brands. Mr. Geib has a strong operating background, which includes new product and brand launches, plant startups and closures, and the development of strategic partner relationships. In addition, Mr. Geib has extensive financial and transactional experience. He has led multiple acquisitions and divestitures of different business units while at Windsor Foods. Prior to joining Windsor Foods, from September 1993 to June 1998, Mr. Geib served as the Executive Vice President of PGI International, a manufacturer of specialty valves and safety equipment. From 1989 to 1991, Mr. Geib was employed by the General Electric Company. Mr. Geib received his Masters of Business Administration from the J.L. Kellogg Graduate School of Management, Northwestern University, and graduated cum laude from the Wharton School, University of Pennsylvania with a Bachelors of Science in Economics. We believe Mr. Geib is qualified to serve on our board of directors because of his strong operating background, including his development of strategic partner relationships, in addition to his extensive financial and transactional experience. | | |

| |

(1) | Except for Mr. Hartman, the address of each director nominees is c/o HMS Income Fund, Inc., 2800 Post Oak Boulevard, Suite 5000, Houston, Texas 77056-6118. The address for Mr. Hartman is 1300 Post Oak Boulevard, Suite 8000, Houston, TX 77056-6118. The age given for each of our directors is as of April 21, 2014. |

| |

(2) | Directors serve for a term until the next annual meeting of stockholders and until their successors are duly elected and qualified. |

| |

(3) | Each of the Interested Directors is an "interested person" of the Company as defined in Section 2(a)(19) of the 1940 Act. Ms. Schugart is an interested person because of her affiliation with our Adviser, Hines and Hines Securities Inc., our dealer manager (the "Dealer Manager"). |

| |

(4) | Pursuant to the terms of investment sub-advisory agreement among our Adviser, Main Street, MSC Adviser I, LLC, a wholly-owned subsidiary of Main Street (“MSC Adviser”) and us (the “Sub-Advisory Agreement”), MSC Adviser provides our Adviser with sub-advisory services. We refer to our Adviser and Sub-Adviser, collectively, as our “Advisers.” Pursuant to the terms of the Sub-Advisory Agreement, and for so long as the Sub-Adviser acts as our Sub-Adviser, whether pursuant to the Sub-Advisory Agreement or otherwise, the Sub-Adviser may select a nominee who shall be nominated to serve as a member of our board of directors. Our Sub-Adviser has nominated Mr. Hartman, who is considered an “interested person” because of his affiliation with Main Street. |

CORPORATE GOVERNANCE

Board Leadership Structure and Role in Risk Oversight

Through its direct oversight role, and indirectly through its committees, the board of directors performs a risk oversight function for the Company consisting of, among other things, the following activities: (1) at regular and special board meetings, and on an ad hoc basis as needed, receiving and reviewing reports related to the performance and operations of the Company, our Advisers and our Dealer Manager (2) reviewing and approving, as applicable, the compliance policies and procedures of the Company; (3) reviewing investment strategies, techniques and the processes used to manage related risks; (4) meeting with representatives of, or reviewing reports prepared by or with respect to, key service providers, including the investment adviser, administrator, distributor, transfer agent, custodian and independent registered public accounting firm of the Company, to review and discuss the activities of the Company and to provide direction with respect thereto; (5) reviewing periodically, and at least annually, the Company’s fidelity bond, directors and officers, and errors and omissions insurance policies and such other insurance policies as may be appropriate; and (6) overseeing the Company’s accounting and financial reporting processes, including supervision of the Company’s independent registered public accounting firm to ensure that they provide timely analyses of significant financial reporting and internal control issues.

The board of directors also performs its risk oversight responsibilities with the assistance of the Company’s Chief Compliance Officer. The board of directors receives a quarterly report from the Chief Compliance Officer, who reports on, among other things, the Company’s compliance with applicable securities laws and its internal compliance policies and procedures. In addition, the Company’s Chief Compliance Officer prepares a written report annually evaluating, among other things, the adequacy and effectiveness of the compliance policies and procedures of the Company and certain of its service providers. The Chief Compliance Officer’s report, which is reviewed by the board of directors, addresses at a minimum: (1) the operation and effectiveness of the compliance policies and procedures of the Company and certain of its service providers since

the last report; (2) any material changes to such policies and procedures since the last report; (3) any recommendations for material changes to such policies and procedures as a result of the Chief Compliance Officer’s annual review; and (4) any compliance matter that has occurred since the date of the last report about which the board of directors would reasonably need to know to oversee the Company’s compliance activities and risks. The Chief Compliance Officer also meets separately in executive session with the independent directors at least once each year. In addition to compliance reports from the Company’s Chief Compliance Officer, the board of directors also receives reports from legal counsel to the Company regarding regulatory compliance and governance matters.

Ms. Schugart has served as chairman of our board of directors since February 28, 2014 and as our chief executive officer and president since March 15, 2013. Ms. Schugart is an “interested person” of the Company as defined in Section 2(a)(19) of the 1940 Act due to her current and former positions with Hines and its affiliated entities. Our board of directors believes that, due to her tenure as our chief executive officer, Ms. Schugart is the director with the most knowledge of the Company’s business strategy and is best situated to serve as chairman of our board of directors.

Our Charter, as well as regulations governing business development companies (“BDCs”) generally, requires that a majority of the board of directors be persons other than “interested persons” of the Company, as defined in Section 2(a)(19) of the 1940 Act. Our board of directors believes that its current leadership structure -an interested person serving as chair of the board of directors and committees led by and consisting solely of independent directors-is the optimal structure for the Company at this time because it allows the Company’s directors to exercise informed and independent judgment, and allocates areas of responsibility among committees of independent directors and the full board of directors in a manner that enhances effective oversight. The board of directors is of the opinion that having a majority of independent directors is appropriate and in the best interest of the Company’s stockholders, but also believes that having interested persons serve as directors brings both corporate and financial viewpoints that are significant elements in its decision-making process. Our board of directors will review its leadership structure periodically to ensure that the leadership structure remains appropriate and will make changes if and when it determines such changes are necessary or proper.

Committees of the Board

The four standing committees of our board of directors are: the Pricing Committee, the Audit Committee, the Nominating and Corporate Governance Committee and the Conflicts Committee. You may obtain copies of the charters for each of the Audit Committee, the Nominating and Corporate Governance Committee and the Conflicts Committee from our website at www.hinessecurities.com/bdcs/hms-income-fund/corporate-governance/. Each of the Audit, Nominating and Corporate Governance and Conflicts committees currently has three members and is composed entirely of independent directors.

Interested parties may communicate matters they wish to raise with the directors by writing to HMS Income Fund, Inc., 2800 Post Oak Boulevard, Suite 5000, Houston, Texas 77056-6118, Attention: Ryan T. Sims, Chief Financial Officer and Secretary. Mr. Sims will deliver all appropriate communications to the Nominating and Corporate Governance Committee of the board of directors, which will, in its discretion, deliver such communications (together with any recommendations) to the board of directors no later than the next regularly scheduled meeting of the board of directors.

The board of directors has not established a standing compensation committee because the executive officers of the Company do not receive any direct compensation from the Company. The board of directors, as a whole, participates in the consideration of director compensation and decisions on director compensation are based on, among other things, a review of data of comparable BDCs.

Pricing Committee

We are prohibited from selling shares of our Common Stock at a price below current net asset value, exclusive of any distributing commission or discount. Our net asset value is based in part on the good faith determination of fair value of certain of our investments by our board of directors. The Pricing Committee is responsible for assisting the board of directors in making its fair value determinations and in ensuring that the shares sold in our continuous offering that are effected at weekly closings do not contravene this restriction. The Pricing Committee considers various factors, including, but not limited to, the valuations of our investment portfolio provided by our Advisers in determining whether the standard has been met. Ms. Schugart and Mr. Hartman currently serve as the members of our Pricing Committee.

Audit Committee

The Audit Committee assists the board of directors in overseeing:

| |

• | the integrity of our financial statements and other information to be provided to our stockholders; |

| |

• | our compliance with legal and regulatory requirements; |

| |

• | the qualifications and independence of our independent registered public accounting firm; |

| |

• | the performance of our risk management function and our independent registered public accounting firm; and |

| |

• | our systems of disclosure controls and procedures and internal controls over financial reporting. |

Messrs. Geib, Niemann and Shaper currently serve as the members of our Audit Committee, and Mr. Niemann serves as the chairman of the Audit Committee. Our board of directors has determined that each of the members of the Audit Committee meets the independence standards established by the SEC for audit committees and is not an “interested person” for purposes of the 1940 Act. In addition, our board of directors has determined that Mr. Niemann is an “audit committee financial expert” as defined by Item 407(d)(5)(ii) of Regulation S-K promulgated under the Exchange Act. Unless otherwise determined by the board of directors, no member of the committee may serve as a member of the Audit Committee of more than two other public companies. During 2013, the Audit Committee held four meetings. All of the members of the committee attended each meeting.

The Audit Committee’s report on our financial statements for the fiscal year ended December 31, 2013 is presented below under the heading “Audit Committee Report.”

Nominating and Corporate Governance Committee

The Nominating and Corporate Governance Committee, in performing its duties:

| |

• | assists our board of directors in identifying individuals qualified to become members of our board of directors; |

| |

• | recommends candidates to our board of directors to fill vacancies on the board of directors and to stand for election by the stockholders at the annual meeting; |

| |

• | recommends committee assignments for directors to the full board of directors; |

| |

• | recommends a successor to the Company’s Chief Executive Officer when a vacancy occurs; |

| |

• | periodically assesses the performance of our board of directors; |

| |

• | reviews and recommends appropriate corporate governance policies and procedures to our board of directors; and |

| |

• | reviews and monitors our code of business conduct and ethics for senior executive and financial officers, and any other corporate governance policies and procedures we may have from time to time. |

Messrs. Geib, Niemann and Shaper currently serve as the members of our Nominating and Corporate Governance Committee, and Mr. Shaper serves as the chairman of the Nominating and Corporate Governance Committee. Our board of directors has determined that each member of our Nominating and Corporate Governance Committee meets the independence standards established by the SEC for governance committees and is not an “interested person” for purposes of the 1940 Act.

When evaluating the suitability of individual nominees for our board of directors (whether such nominations are made by management, a stockholder or otherwise), the committee considers, among other things, each nominee’s:

| |

• | personal and professional integrity, experience and skills; |

| |

• | ability and willingness to devote the time and effort necessary to be an effective board member; and |

| |

• | commitment to acting in our best interests and the best interests of our stockholders. |

The committee also gives consideration to the diversity of the board of directors in terms of having an appropriate mix of experience, education and skills, the requirements contained in our Charter and each nominee’s ability to exercise independence of thought, objective perspective and mature judgment and understand our business operations and objectives.

If the board of directors determines to seek additional directors for nomination, the Nominating and Corporate Governance Committee considers whether it is advisable to retain a third-party search firm to identify candidates. During 2013, the committee paid no fees to third-parties to assist in identifying or evaluating potential nominees. The Nominating and Corporate Governance Committee also considers nominees timely submitted by stockholders under and in accordance with the provisions of our Bylaws. For additional information regarding this process, see “Stockholder Proposals for the 2015 Annual Meeting” below. A stockholder’s notice must set forth specified information as to each person whom the stockholder proposes to nominate for election to the board of directors, including all information relating to such person that is required to be disclosed in solicitations of proxies for election of directors in an election contest, or is otherwise required, by Regulation 14A under the Exchange Act (including such person’s written consent to being named in the proxy statement as a nominee and to serve as a director if elected). The Nominating and Corporate Governance Committee will consider all such nominees and will take into account all factors the committee determines are relevant, including the factors summarized above.

During 2013, the Nominating and Corporate Governance Committee was comprised of three members and held three meetings. All of the members of the committee attended the meetings.

Conflicts Committee

Messrs. Geib, Niemann and Shaper currently serve as the members of our Conflicts Committee, and Mr. Niemann serves as the chairman of the Conflicts Committee. The Conflicts Committee reviews and approves specific matters that the board of directors believes may involve conflicts of interest to determine whether the resolution of the conflict of interest is fair and reasonable to us and our stockholders. The Conflicts Committee is responsible for reviewing and approving the terms of all transactions between us, on one hand, and our Adviser, our Sub-Adviser, Hines or any member of our board of directors, or any of their respective affiliates, on the other hand, including but not limited to the annual renewal of the investment advisory and administrative services agreement (the “Investment Advisory Agreement”) between us and our Adviser, the Sub-Advisory Agreement and the dealer manager agreement between us and the Dealer Manager. The Conflicts Committee is also responsible for reviewing and approving each purchase or lease by us of property from an affiliate or purchase or lease by an affiliate from us. The Conflicts Committee is responsible for reviewing our Advisers’ performance and the fees and expenses paid by us to our Advisers and any of their respective affiliates. The review of such fees and expenses is required to be performed with sufficient frequency, but at least annually, to determine that the expenses incurred are in the best interest of our stockholders.

During 2013, the Conflicts Committee held two meetings. All members of the committee attended the meetings. The Conflicts Committee has reviewed our policies and reports that they are being followed by us and are in the best interests of our stockholders.

Our full board of directors reviewed the material transactions between our Adviser, our Sub-Adviser and Hines and their respective affiliates and the Company that occurred during 2013, which transactions are described in “Certain Relationships and Related Transactions” below, and has determined that all our transactions and relationships with our Advisers and Hines and their respective affiliates during 2013 were fair and were approved in accordance with the policies referenced in “Certain Relationships and Related Transactions” below.

Communications Between Stockholders and the Board of Directors

The board of directors welcomes communications from the Company’s stockholders. Stockholders may send communications to the board of directors or to any particular director to the following address: HMS Income Fund, Inc., 2800 Post Oak Boulevard, Suite 5000, Houston, Texas 77056-6118, Attention: Ryan T. Sims, Chief Financial Officer and Secretary. Stockholders should indicate clearly the director or directors to whom the communication is being sent so that each communication may be forwarded directly to the appropriate director(s).

Information about Executive Officers Who Are Not Directors

The following table sets forth certain information regarding the executive officers of the Company who are not directors of the Company: |

| | | | |

Name, Address, Age and Position(s) with Company(1) | | Term of Office and Length of Time Served | | Principal Occupations During Past Five Years |

| | | | |

Ryan T. Sims Age: 42 Chief Financial Officer and Secretary | | Since 2011 | | Mr. Sims joined Hines in August 2003. Mr. Sims serves as our Chief Financial Officer and Secretary. Mr. Sims is also the Chief Financial Officer and Secretary of the general partner of our Adviser. Mr. Sims has also served as the Chief Financial Officer and Secretary for Hines Global REIT and the general partner of its adviser since November 2011 and as the Chief Financial Officer and Secretary of Hines REIT, the general partner of its adviser and the Core Fund since November 2011. Mr. Sims holds similar positions with several related Hines entities. In these positions, Mr. Sims is responsible for the oversight of financial operations, equity and debt financing activities, investor relations, accounting, financial reporting, tax, legal, compliance and administrative functions in the U.S. and internationally. Prior to this time, Mr. Sims served as the Chief Accounting Officer for Hines Global REIT and the general partner of its adviser since their inception in December 2008. Mr. Sims also served as the Chief Accounting Officer for Hines REIT, the general partner of its adviser and the Core Fund since April 2008. In these roles, he was responsible for the oversight of the accounting, financial reporting and SEC reporting functions, as well as the Sarbanes-Oxley compliance program in the U.S. and internationally. He was also responsible for establishing the companies’ accounting policies and ensuring compliance with those policies in the U.S. and internationally. He has also previously served as a Senior Controller for Hines REIT and the general partner of its adviser from August 2003 to April 2008 and the Core Fund from July 2004 to April 2008. Prior to joining Hines, Mr. Sims was a manager in the audit practice of Arthur Andersen LLP and Deloitte & Touche LLP, serving clients primarily in the real estate industry. He holds a Bachelor of Business Administration degree in Accounting from Baylor University and is a certified public accountant. |

| | | | |

Susan Dudley Age: 44 Chief Compliance Officer | | Since 2011 | | Ms. Dudley joined Hines in 2005. Ms. Dudley serves as our Chief Compliance Officer and she is the Chief Compliance Officer of the general partner of our Adviser. She is also the Chief Compliance Officer for Hines Securities, Inc. In these roles, she is responsible for overseeing the day-to-day compliance activities, including developing, maintaining and testing supervisory policies and procedures, monitoring new regulatory mandates and requirements, and developing training and education programs. Ms. Dudley also served as Controller and Financial Operations Principal for Hines Securities, Inc. from April 2005 to November 2008. Prior to joining Hines Securities, Inc., she was the chief financial officer for Btek Group, LP from June 2002 to December 2004. Prior to that, Ms. Dudley served as the controller for California Tan, Inc. and Diamond Geophysical Service Corp. Ms. Dudley also spent four years at Arthur Andersen in the audit department. She graduated from Pepperdine University with a B.S. in Accounting and is a certified public accountant. Ms. Dudley holds her Series 7, 24, 28 and 79 securities licenses and the Certified Regulatory Compliance Professional designation from the FINRA Institute at Wharton. |

| | | | |

Margaret Fitzgerald Age: 34 Controller | | Since 2013 | | Ms. Fitzgerald joined Hines in July 2008. Ms. Fitzgerald serves as our Controller and is currently the Senior Controller of our Adviser. In this role, Ms. Fitzgerald is responsible for the oversight of the accounting and financial reporting functions of this entity. Prior to this time, Ms. Fitzgerald served as a Senior Controller for the general partner of the advisors for Hines Real Estate Investment Trust and Hines Global REIT. In these roles, she was responsible for technical accounting and reporting matters. Additionally, she has served and continues to provide accounting policy guidance to other Hines entities. Prior to joining Hines, Ms. Fitzgerald worked for Navigant Consulting and in the Division of Corporation Finance at the Securities and Exchange Commission. Additionally, prior to joining Hines, she worked in the audit practice of KPMG LLP, serving clients in the financial services industry. She holds a Bachelor of Arts in Accounting from Southwestern University and is a certified public accountant. |

| |

(1) | The address for each executive officer is c/o HMS Income Fund, Inc., 2800 Post Oak Boulevard, Suite 5000, Houston, Texas 77056-6118. The age given for each of our executive officers is as of April 21, 2014. |

Compensation Discussion and Analysis

We currently have no employees. Our Adviser, with the assistance of our Sub-Adviser, performs our day-to-day management functions. Our executive officers are all employees of our Adviser. We do not pay any of these individuals for serving in their respective positions. See “Certain Relationships and Related Transactions” below for a discussion of fees and expenses payable to our Advisers and their respective affiliates.

Code of Ethics

We have adopted a code of ethics pursuant to Rule 17j-1 under the 1940 Act, and our Advisers have each adopted a code of ethics pursuant to Rule 204A-1 under the Investment Advisers Act of 1940, as amended (the “Advisers Act”). The codes of ethics establish procedures for personal investments and restrict certain personal securities transactions. Personnel subject to each code may invest in securities for their personal investment accounts, including securities that may be purchased or held by us, so long as such investments are made in accordance with the code’s requirements. Our code of ethics is available, free of

charge, on the Corporate Governance section of our website, www.hinessecurities.com/bdcs/hms-income-fund/corporate-governance/. You may also obtain a copy of this code by writing to: HMS Income Fund, Inc., Investor Relations, 2800 Post Oak Boulevard, Suite 5000, Houston, Texas 77056-6118. You may also read and copy our code of ethics at the SEC’s Public Reference Room located at 100 F Street, NE, Washington, DC 20549. You may obtain information on the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330. In addition, our code of ethics is available on the EDGAR Database on the SEC’s Internet site at http://www.sec.gov. You may also obtain copies of our code of ethics, after paying a duplicating fee, by electronic request at the following e-mail address: publicinfo@sec.gov, or by writing the SEC’s Public Reference Section, 100 F Street, NE, Washington, DC 20549.

Item 406 of Regulation S-K requires us to disclose whether we have adopted a code of ethics that applies to our principal executive officer, principal financial officer, principal accounting officer or controller, or persons performing similar functions. We have adopted such a code, which we describe as our Code of Business Conduct, and we are in compliance with Item 406 of Regulation S-K. Our Code of Business Conduct can be accessed via the Corporate Governance section of our website listed above. We intend to disclose any amendments to or waivers of required provisions of the Code of Business Conduct on our website. We will provide any person, without charge, upon request, a copy of our Code of Business Conduct. To receive a copy, please send a written request to the address listed above.

Required Vote

Each director shall be elected by a plurality of all the affirmative votes cast at the Annual Meeting in person or by proxy, provided that a quorum is present. For purposes of the election of directors, abstentions and broker non-votes, if any, will not be counted as votes cast and will have no effect on the result of the vote.

DIRECTOR COMPENSATION

Prior to holding our initial closing, our directors were not entitled to compensation. Subsequent to holding our initial closing in September 2012, our independent directors became entitled to the compensation described below.

We pay our independent directors an annual fee of $30,000, and a fee of $2,500 for each meeting of the board of directors attended in person, $1,000 for each committee meeting attended in person on a day when the board of directors meeting was held, $2,500 for each committee meeting attended in person on a day when no board of directors meeting was held, and $500 for each board of directors or committee meeting attended via teleconference.

Additionally, the chairpersons of certain committees of the board of directors are entitled to the following amounts:

| |

• | $10,000 to the chairperson of the Audit Committee of the board of directors; |

| |

• | $5,000 to the chairperson of the Conflicts Committee of the board of directors; and |

| |

• | $5,000 to the chairperson of the Nominating and Corporate Governance Committee of the board of directors. |

We reimburse all of our directors for reasonable out-of-pocket expenses incurred in connection with their service on the board of directors.

The following table sets forth information regarding compensation paid to our directors during the fiscal year ended December 31, 2013.

2013 Director Compensation

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Name of Director | | Fees Earned or Paid in Cash | | Stock

Awards | | Option

Awards | | Non-Equity

Incentive

Plan Compensation | | Change in Pension Value and Non- Qualified Deferred Compensation Earnings | | All Other Compensation | | Total Compensation |

Interested Directors: | | | | | | | | | | | | | | |

Sherri W. Schugart | | $ | — |

| | $ | — |

| | $ | — |

| | $ | — |

| | $ | — |

| | $ | — |

| | $ | — |

|

Curtis L. Hartman | | — |

| | — |

| | — |

| | — |

| | — |

| | — |

| | — |

|

Charles N. Hazen(1) | | — |

| | — |

| | — |

| | — |

| | — |

| | — |

| | — |

|

Independent Directors: | | | | | | | | | | | | | | — |

|

Gregory R. Geib | | 19,500 |

| | — |

| | — |

| | — |

| | — |

| | — |

| | 19,500 |

|

Peter Shaper | | 45,000 |

| | — |

| | — |

| | — |

| | — |

| | — |

| | 45,000 |

|

John O. Niemann, Jr. | | 54,579 |

| | — |

| | — |

| | — |

| | — |

| | — |

| | 54,579 |

|

Phil D. Wedemeyer (2) | | 1,685 |

| | — |

| | — |

| | — |

| | — |

| | — |

| | 1,685 |

|

| |

(1) | Mr. Hazen resigned from the board of directors effective February 27, 2014. Because Mr. Hazen was previously the President and Chief Executive Officer of HMS Adviser, he was considered and “interested person” of the Company. Accordingly, he received no additional compensation for serving as a director of the Company. |

| |

(2) | Phil D. Wedemeyer resigned from the board of directors effective January 15, 2013. |

The following table sets forth the dollar range of equity securities of the Company that were beneficially owned by each director as of April 21, 2014:

|

| | |

Name and Address(1) | | Dollar Range of Equity Securities Beneficially Owned(2)(3)(4) |

Interested Directors: | | |

Sherri W. Schugart | | None |

Curtis L. Hartman | | None |

Independent Directors: | | |

Gregory R. Geib | | None |

Peter Shaper | | None |

John O. Niemann, Jr. | | None |

| |

(1) | Except for Mr. Hartman, the address of each director nominees is c/o HMS Income Fund, Inc., 2800 Post Oak Boulevard, Suite 5000, Houston, Texas 77056-6118. The address for Mr. Hartman is 1300 Post Oak Boulevard, Suite 8000, Houston, TX 77056-6118. |

| |

(2) | Beneficial ownership has been determined in accordance with Rule 16a-1(a)(2) of the Exchange Act. |

| |

(3) | The dollar range of equity securities beneficially owned by our directors is based on the current offering price of $10.00 per share. |

| |

(4) | The dollar range of equity securities beneficially owned is: None, $1 – $10,000, $10,001 – $50,000, $50,001 – $100,000, or over $100,000. |

STOCK OWNERSHIP BY DIRECTORS,

EXECUTIVE OFFICERS AND CERTAIN STOCKHOLDERS

Ownership

The following table sets forth information with respect to the beneficial ownership of shares of our Common Stock as of April 21, 2014 by (1) any person who is known by us to be the beneficial owner of more than 5% of the outstanding shares of our Common Stock, (2) our directors, (3) our executive officers and (4) all of our directors and executive officers as a group. Except as otherwise indicated, all shares are owned directly, and the owner of such shares has the sole voting and investment power with respect thereto. |

| | | | | | |

| | Shares Beneficially Owned

as of April 21, 2014 |

Name and Address(1) | | Number(2) | | Percentage(3) |

5% Stockholders: | | | | |

HMS Investor LLC(4) | | 861,323.81 |

| | 8.4 | % |

Interested Directors: | | | | |

Sherri W. Schugart | | — |

| | — |

|

Curtis L. Hartman | | — |

| | — |

|

Independent Directors: | | | | |

Gregory R. Geib | | — |

| | — |

|

Peter Shaper | | — |

| | — |

|

John O. Niemann, Jr. | | — |

| | — |

|

Officers (that are not directors) | | | | |

Ryan T. Sims | | — |

| | — |

|

Susan Dudley | | 2,718.94 |

| | * |

|

Margaret Fitzgerald | | — |

| | — |

|

All officers and directors as a group (eight persons) | | 2,718.94 |

| | * |

|

| |

* | Represents less than 1.0%. |

| |

(1) | The address of each beneficial owner is c/o HMS Income Fund, Inc., 2800 Post Oak Boulevard, Suite 5000, Houston, Texas 77056-6118. |

| |

(2) | For purposes of this table, “beneficial ownership” is determined in accordance with Rule 13d-3 under Exchange Act pursuant to which a person is deemed to have “beneficial ownership” of shares of our stock that the person has the right to acquire within 60 days. For purposes of computing the percentage of outstanding shares of the Company’s stock held by each person or group of persons named in the table, any shares that such person or persons have the right to acquire within 60 days of April 21, 2014 are deemed to be outstanding, but are not deemed to be outstanding for the purpose of computing the percentage ownership of any other persons. |

| |

(3) | Based on a total of 10,282,950 shares issued and outstanding as of April 21, 2014. |

| |

(4) | HMS Investor LLC is a Delaware limited liability company. Hines Investment Holdings Limited Partnership is the 92% member of HMS Investor LLC and, as such, has voting and dispositive power over the 861,323.81 shares owned by HMS Investor LLC. JCH Investments, Inc. is the general partner of Hines Investment Holdings Limited Partnership and, as such, shares voting and dispositive power over the 861,323.81 shares held by HMS Investor LLC. As a result of his position at JCH Investments, Inc., Jeffrey C. Hines also shares voting and dispositive power over the 861,323.81 shares held by HMS Investor LLC. |

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Exchange Act requires our directors, executive officers and any person owning more than ten percent of our Common Stock to file initial reports of ownership, reports of changes in ownership and annual reports of ownership with the SEC. These persons are required by SEC regulations to furnish us with copies of all Section 16 forms that they file with the SEC. Based on our review of any Forms 3, 4 or 5 filed by such persons and information provided by our directors and officers,

we believe that during the fiscal year ended December 31, 2013, all Section 16(a) filing requirements applicable to such persons were timely filed.

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS

Our Advisers

Our Adviser, HMS Adviser LP, is a Texas limited partnership formed on April 13, 2012 that is registered as an investment adviser under the Advisers Act. Our Adviser is wholly-owned by Hines. Hines is indirectly owned and controlled by Gerald D. Hines and Jeffrey C. Hines. Our chief executive officer, chief financial officer and chief compliance officer and the other investment professionals may also serve as principals of other investment managers affiliated with our Adviser or Hines that may in the future manage investment funds with an investment objective similar to ours.

On December 12, 2011, HMS Investor LLC, an affiliate of Hines, and DJ-PEI Partners purchased 1,111,111 units of membership interest in HMS Income LLC for a price of $9.00 per unit or an aggregate of $10 million, $7.5 million of which was contributed by HMS Investor LLC and the remaining $2.5 million of which was contributed by DJ-PEI Partners. An executive officer of DJ-PEI Partners is also an independent director of Main Street. Simultaneous with that initial capitalization, HMS Income LLC entered into a senior secured single advance term loan credit facility with Main Street in the committed principal amount of $7.5 million, which loan has subsequently been repaid with borrowings from a credit facility HMS Income LLC entered into on May 24, 2012, and the Company thereafter assumed, as described below. Additionally, pursuant to a letter agreement between the parties, HMS Investor LLC has the right to sell to Main Street up to one-third of its equity interest in the Company at a price per share equal to the then current price to the public in the offering (less the selling commissions and dealer manager fee of 10%) at the time of exercise of the right. HMS Investor may exercise the right from time to time, in whole or in part, subject only to the condition that immediately following Main Street’s purchase, Main Street’s ownership in the Company would not exceed the limits on investment company ownership of other investment companies as set forth in the 1940 Act.

Any transaction with our affiliates must be fair and reasonable to us and on terms no less favorable than could be obtained from an unaffiliated third party and must be approved by a majority of the directors who have no financial interest in such transaction, including a majority of such directors who are also independent directors.

We entered into an Investment Advisory Agreement with our Adviser pursuant to which we pay our Adviser a fee for its services consisting of two components - a management fee and an incentive fee. The management fee is calculated at an annual rate of 2.0% of our average gross assets. The term “gross assets” means all assets of the Company, including cash and cash equivalents. The incentive fee consists of two parts. The first part, which is referred to as the subordinated incentive fee on income, is calculated and payable quarterly in arrears and equals 20.0% of our pre-incentive fee net investment income for the immediately preceding quarter, expressed as a quarterly rate of return on adjusted capital at the beginning of the most recently completed calendar quarter, exceeding 1.875% (7.5% annualized), subject to a “catch up” feature. For purposes of this fee, adjusted capital means cumulative gross proceeds generated from sales of our common stock (including proceeds from our distribution reinvestment plan) reduced for non-liquidating distributions, other than distributions of profits, paid to our stockholders and amounts paid for share repurchases pursuant to our share repurchase program. The second part of the incentive fee, which is referred to as the incentive fee on capital gains, is an incentive fee on realized capital gains earned from the portfolio of the Company and is determined and payable in arrears as of the end of each calendar year (or upon termination of the Investment Advisory Agreement). This fee equals 20.0% of our incentive fee capital gains, which equals our realized capital gains on a cumulative basis from inception, calculated as of the end of each calendar year, computed net of all realized capital losses and unrealized capital depreciation on a cumulative basis, less the aggregate amount of any previously paid capital gain incentive fees.

The Sub-Advisory Agreement among our Adviser, Main Street, MSC Adviser and us provides that our Sub-Adviser will receive 50% of all fees payable to our Adviser under the Investment Advisory Agreement.

Additionally, pursuant to our Investment Advisory Agreement, to the extent necessary, our Adviser, with the assistance of our Sub-Adviser, provides certain administrative services in connection with the proper conduct and operation of our business, including, but not limited to, legal, accounting, tax, insurance and investor relation services, to us. We are required to reimburse our Advisers for the actual cost of the administrative services they provide. We are also required to reimburse our Advisers for the actual expenses they or their affiliates, or any third-party administrator incur in connection with the provision of administrative services to us, including the personnel and related employment direct costs and overhead of our Advisers or their

affiliates, or any third-party administrator for provision of administrative services (as opposed to investment advisory services). We are not required to reimburse our Advisers for personnel costs in connection with services for which our Advisers or their affiliates, or any third-party administrator receives a separate fee.

The Investment Advisory Agreement provides that our Advisers and their respective officers, directors, controlling persons and any other person or entity affiliated with them acting as our agent shall be entitled to indemnification (including reasonable attorneys’ fees and amounts reasonably paid in settlement) for any liability or loss suffered by such indemnitee, and such indemnitee shall be held harmless for any loss or liability suffered by us, if (i) the indemnitee has determined, in good faith, that the course of conduct which caused the loss or liability was in the Company’s best interests, (ii) the indemnitee was acting on behalf of or performing services for the Company, (iii) the liability or loss suffered was not the result of negligence or misconduct by the indemnitee or an affiliate thereof acting as the Company’s agent and (iv) the indemnification or agreement to hold the indemnitee harmless is only recoverable out of the Company’s net assets and not from the Company’s stockholders.

Due to the conditional fee waiver described below, we did not pay any fees under the Investment Advisory Agreement during the year ended December 31, 2013.

Ms. Schugart is the Chairman, Chief Executive Officer and President of the Company and is the President and Chief Executive Officer of the general partner of our Adviser. Similarly, Mr. Sims, Ms. Dudley and Ms. Fitzgerald are the Chief Financial Officer, Chief Compliance Officer and Controller of the Company, respectively, and hold the same positions with the general partner of our Adviser or with our Adviser, as applicable. Officers of the general partner of our Adviser and of our Adviser receive a benefit from the fees paid to our Adviser pursuant to the Investment Advisory Agreement. Our board of directors, which consists of a majority of independent directors, has approved the Investment Advisory Agreement, including the fees paid pursuant to such agreement.

Mr. Hartman is Chief Credit Officer and a Senior Managing Director of Main Street and holds a similar position in our Sub-Adviser. Officers and managers of our Sub-Adviser receive a benefit from the fees paid to our Sub-Adviser pursuant to the Sub‑Advisory Agreement. Our board of directors, which consists of a majority of independent directors, has approved the Sub-Advisory Agreement, including the fees paid pursuant to such agreement.